Tested by turmoil yet driven by resilience, Bangladesh enters the final stretch of 2025 confronting fires, strikes, and fragile reforms, yet within these trials lie new openings to rebuild smarter, adapt faster, and redefine the path toward a more secure and inclusive future.

In 2025, Bangladesh’s economy didn’t stumble because of global headwinds alone — it burned, quite literally, at home.

On October 18, a massive fire tore through the cargo complex of Hazrat Shahjalal International Airport, destroying nearly USD 1 billion worth of garments, raw materials, and export documents. Days earlier, another blaze had gutted the Adams Caps & Textile factory inside the Chattogram EPZ, halting production. That same week, garment giant Pacific Jeans temporarily closed eight units after worker clashes idled 35,000 employees and halted 100,000 denim shipments daily.

These weren’t isolated disruptions. A customs strike in June choked trade lanes, a cargo vessel sank off Chattogram with over 1,200 tonnes of ceramic clay, and a transport strike paralysed container movement at the port.

For an economy where over 80% of exports depend on ready-made garments (RMG) and logistics lifelines sustain growth, these incidents are more than local crises — they’re structural warning signs. Bangladesh, long called a “development miracle,” is now confronting inflationary pressure, forex constraints, and eroding investor confidence.

The question is no longer how fast the economy can grow but how well it can adapt, diversify, and reform.

STRENGTHS

Youth, Industry, Infrastructure, and Resilience

Despite 2025’s turbulence, Bangladesh’s economic foundations remain robust and evolving.

At the heart of the country’s strength is its youth. With more than 60% of the population under 35, Bangladesh continues to reap a demographic dividend. This young, working-age population fuels both industry and a fast-growing middle class — projected to reach 34 million by 2025 — driving demand for housing, healthcare, and digital services.

The RMG sector remains Bangladesh’s economic engine, contributing about 81.5% of total exports worth USD 48.28 billion in FY2024–25. Despite disruptions, RMG earnings grew by 8.84% year-on-year to USD 39.34 billion, aided by diversification into non-traditional markets like Japan and Australia. The sector continues to modernise through automation and sustainable production, making Bangladesh home to the world’s largest cluster of LEED-certified green factories.

Innovation beyond traditional industries is reshaping Bangladesh’s economy. Fintech leaders like bKash and Nagad are expanding into microcredit, while agritech startups are digitising rural supply chains. Around 7.8 million MSMEs contribute nearly a quarter of GDP and 40% of manufacturing, showing remarkable adaptability in digital payments, e-commerce, and subcontracting.

Decades of investment are paying off. The Padma Bridge has cut Dhaka–south transit times by hours, improving trade and real estate connectivity. The Dhaka Metro Rail has eased urban mobility, and power generation capacity now exceeds 30,000 MW, boosting industrial productivity. These projects enable regional integration and trade competitiveness, which are vital for post-LDC graduation.

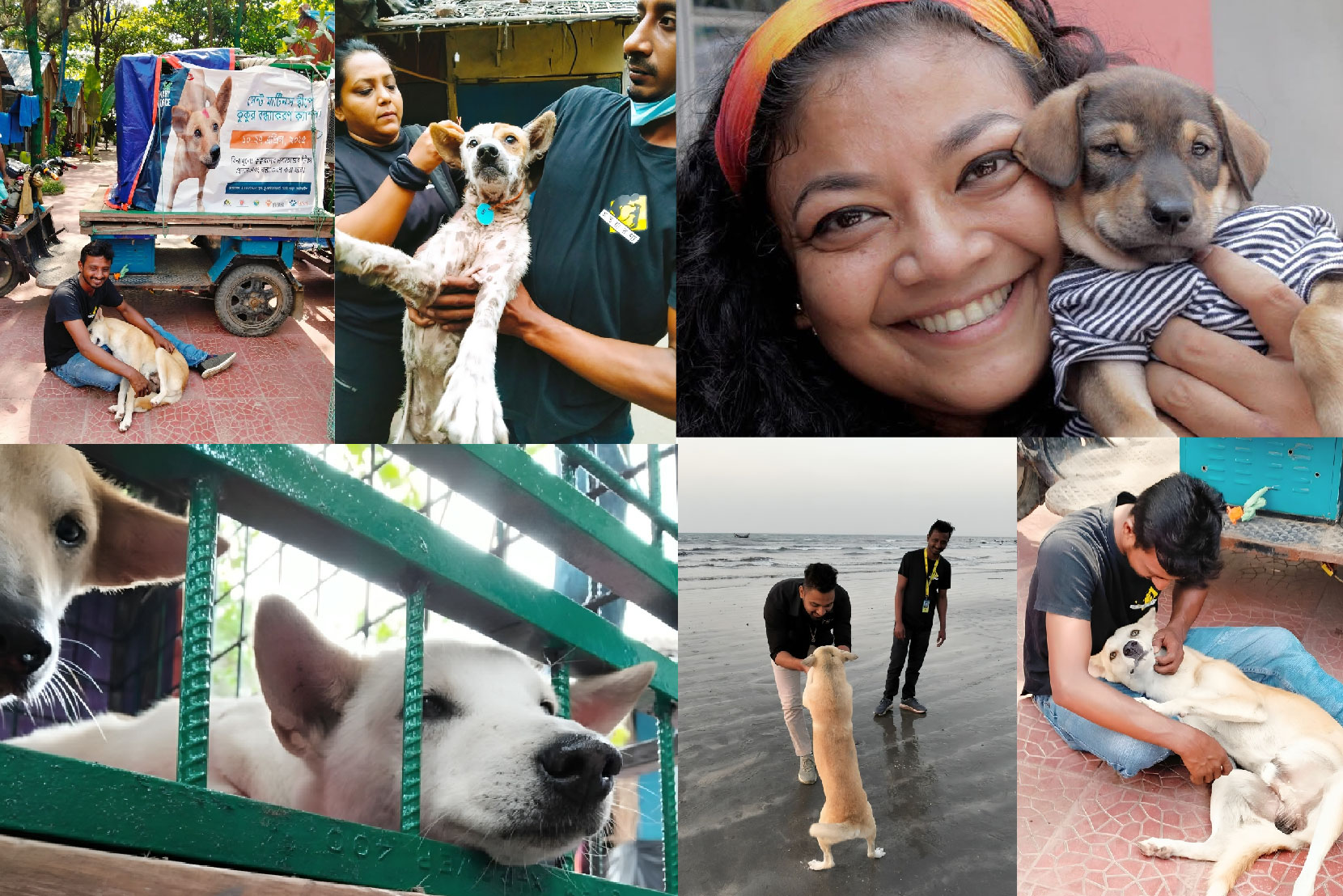

At its core, Bangladesh’s greatest strength remains its people — resilient entrepreneurs and workers who adapt, innovate, and persist even when systems falter.

2025 MADE ONE THING CLEAR: GROWTH WITHOUT REFORM IS FRAGILE. STABILISED RESERVES AND POLICY TIGHTENING PROVIDE TEMPORARY RELIEF, BUT STRUCTURAL VULNERABILITIES – FROM FISCAL WEAKNESS TO IMPORT RIGIDITY – REMAIN UNRESOLVED.

CHALLENGES

Macroeconomy, Governance, Labour Market, and Investments

If Bangladesh’s strengths are its scaffolding, 2025 exposed the cracks beneath it.

The taka appreciated slightly by about 0.4% in July FY2024–25, supported by stronger remittance inflows and lower import demand, while foreign reserves stabilised around USD 32.11 billion by late October. While this improved buffer suggests some stability, it remains unclear whether reserves fully cover three months of imports. Dollar shortages have delayed fuel and raw material imports, constraining energy-intensive and export sectors. Stricter LC controls and import curbs have also dampened investor sentiment.

Weak fiscal governance remains a core constraint. With a tax-to-GDP ratio under 7% — among the lowest in Asia — Bangladesh struggles to fund infrastructure or cushion shocks. Reforms in subsidy targeting and state-owned enterprise (SOE) restructuring have stalled, while the central bank faces scrutiny for limited autonomy. Conflicting directives from ministries on trade, energy, and licensing have fostered uncertainty, eroding business confidence.

More than 84% of export earnings still come from garments. Other sectors — pharmaceuticals, ICT, leather, and agro-processing — together contribute less than 10%. This narrow export base leaves the economy vulnerable to shocks, as seen with the Dhaka Airport cargo fire and Pacific Jeans shutdown.

Bangladesh’s youthful workforce isn’t yet future-ready. According to the BIDS Labour Market Survey 2025, graduate unemployment has tripled in a decade to over 13%. One in three jobless Bangladeshis holds a university degree. Worker unrest, like the October walkouts in Chattogram, underscores discontent over wages and inflation. Productivity still lags behind competitors such as Vietnam and Cambodia.

Private investment is subdued. FDI rose 11% in FY2024–25 — the highest in three years — but most inflows came from reinvested earnings, not new equity. Policy uncertainty, energy shortages, and red tape persist, while of 87 planned Special Economic Zones (SEZs), only a fraction are operational.

2025 made one thing clear: growth without reform is fragile. Stabilised reserves and policy tightening provide temporary relief, but structural vulnerabilities – from fiscal weakness to import rigidity – remain unresolved.

POTENTIAL

Export, Land and Sea, Logistics, and Remittance

Amid volatility, Bangladesh still holds real opportunities — if it can align vision with execution.

Garments will remain central, but growth now depends on new sectors. Pharmaceutical exports crossed USD 200 million in FY2025, and ICT services, including BPO, generated over USD 1 billion (Bangladesh Association of Software and Information Services). Agro-processing — from shrimp to jute — is expanding quietly. The challenge is scale and consistency.

Renewable energy capacity is climbing — solar installations rose from about 950 MW in 2023 to over 1,300 MW by 2025, forming most of the country’s 1.5 GW renewable portfolio. The government aims for 20% renewable power by 2030 (SREDA). The “blue economy” is also emerging, with the Bay of Bengal’s untapped fisheries, shipping routes, and offshore energy drawing new feasibility studies.

Bangladesh’s location between South and Southeast Asia offers vast untapped logistics potential. The Padma Bridge already lowers Dhaka–Kolkata trade costs, while BBIN and BIMSTEC connectivity projects are progressing. Regional partners now eye Bangladeshi ports for cross-border trade — a chance to become a logistics hub if port automation and customs reforms accelerate.

Remittances grew 7.3% year-on-year, reaching USD 1.92 billion in the first 22 days of October, according to Bangladesh Bank — a critical stabiliser for the economy. Analysts argue remittance-linked savings and diaspora bonds could transform these inflows from consumption into productive investment in housing, SMEs, and infrastructure.

A growing middle class is reshaping consumption patterns. Urban housing, healthcare, and e-commerce are booming, driven by rapid digital payment adoption. Mobile financial transactions already exceed BDT 17 lakh crore and are expected to reach BDT 25 lakh crore by 2025, highlighting how digitisation is driving inclusion and entrepreneurship.

INVESTMENT IN R&D FOR BIOTECH, CLEAN ENERGY, AND AUTOMATION IS KEY. STARTUPS NEED TAX HOLIDAYS, REGULATORY SANDBOXES, AND FINANCING. WITHOUT INNOVATION, PRODUCTIVITY GROWTH WILL STAGNATE.

THE WAY AHEAD

Policy Reforms, Human Capital, Sustainability, and Technology

2025 showed that Bangladesh can no longer coast on momentum alone. The next phase demands discipline, coordination, and reform.

Fiscal stability must be restored through a broader tax base, digitalised collection, and rationalised subsidies. The central bank needs greater autonomy to manage inflation and liquidity. The IMF’s Extended Credit Facility (ECF) provides a roadmap, but progress on revenue and financial reforms has lagged as of Q3 2025.

Bangladesh’s youth dividend depends on employability. A recent report by the Task Force on Economy and Resources, submitted to the chief adviser, found that most graduates from national universities — over 60% of the total pool — earn degrees with minimal relevance to job markets. Public-private partnerships and investment in technical, English, and digital skills are vital to close the gap.

Development must be climate-smart and inclusive. Priorities include flood- and cyclone-resistant infrastructure, river management, and saline-tolerant crops. The government should leverage funds such as the Green Climate Fund and Loss & Damage Fund to finance coastal protection and renewables. Expanding renewables — targeting 30% by 2041 — will cut fuel imports and emissions. Enforcing environmental laws, extending green building standards, and investing in waste-to-energy and early-warning systems (reaching 99% of households) can turn climate risk into opportunity. As the World Bank noted in 2025, coordinated cross-sector action is crucial.

“Digital Bangladesh” expanded access; “Smart Bangladesh” must foster innovation. Investment in R&D for biotech, clean energy, and automation is key. Startups need tax holidays, regulatory sandboxes, and financing. Without innovation, productivity growth will stagnate.

Bangladesh needs a coherent economic story — not just to inspire citizens but to assure investors. The Smart Bangladesh 2041 vision is a foundation, but it must be matched by milestones: LDC graduation, middle-income consolidation, and climate-resilient infrastructure by 2030. The Delta Plan 2100 and Perspective Plan 2041 must align through stronger cross-ministry coordination and communication.

Bangladesh’s economic story has never been linear. It has advanced through the resilience of workers, entrepreneurs, and citizens who push ahead despite institutional inertia. The disruptions of 2025 made one truth clear: the old playbook is exhausted.

The next chapter will be written not by momentum, but by reform — and by the courage to turn resilience into renewal.