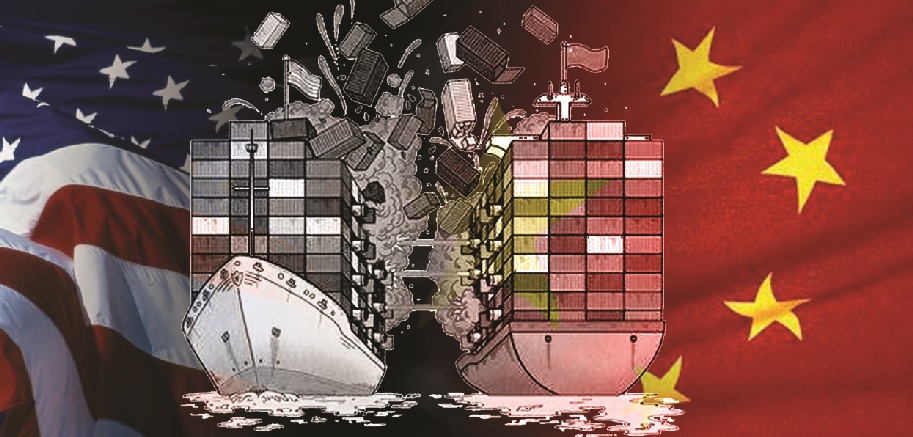

There has been tension brewing among foreign firms operating in China. Day by day, they are losing business to their Chinese counterparts. Such concerns have even triggered a major trade row between the US and China. Chinese firms are rapidly absorbing technologies from foreign firms, and they are succeeding in making similar products on their own, raising the question of future innovation leadership. Which country will be the leader in global innovation in the 21st century, as Wharton dean Geoffrey Garrett writes in this opinion piece, is the underlying reason for growing US-China trade row. China’s extraordinary capability to adopt and adapt foreign technologies at an extreme speed and massive scale appear to be posing a threat to American dominance in key areas of the innovation economy. It is quite ironic that American recent innovation success stories such as Apple’s product, iPhone thrive on China’s surprising capability. Slapping punitive tariffs is hurting the global economy in general, particularly in the US and China. Starting from Soybeans and Steel, protection measures are now moving to high-tech. Chinese firms like Huawei or ZTE are facing embargo. Additionally, American technology firms are also experiencing the pain—slowing down economic growth. How to stop this is baffling the minds of trade experts.

The core issue- Chinese firms misappropriate foreign technology

Foreign firms operating in China, particularly in the business of technology-centric products, have been complaining about China’s appetite, as well as approach, for the absorption of technologies. As claimed in the policy brief of Peterson Institute for International Economics, “A broad range of experts and market observers agree that China has repeatedly forced foreign multinational corporations (MNCs) to transfer technology to indigenous firms as a condition for market access and that China has persistently failed to protect the intellectual property of foreign firms doing business in China.” On the other hand, China claims that the use of ‘forced’ transfer of technology is unsubstantiated. Yes, China has openly expressed the willingness to absorb and digest state-of-the-art key foreign technologies, like Artificial Intelligence, and electric self-driving cars. China also admits that there are incentives for foreign firms to cooperate to transfer technologies to their Chinese counterparts. Upon being tempted by those incentives, like many others, American firms also formed partnerships with Chinese firms. And those partnerships are in diverse forms starting from joint bidding for government-funded projects to collaborative production as well as contract manufacturing. Through the process of this association, Chinese firms often acquired the know-how from foreign firms—which appears to be the outcome of the natural process of learning through association. Moreover, to increase the absorption capacity, China has increased R&D funding on a massive scale. As a result, Chinese firms are increasingly showing stronger technological capability—often posing a threat of becoming competitors.

Growing technology capability of Chinese firms is undermining American success

For many reasons, including incentives, high-skilled manpower, superb logistics, large domestic market, and rich ecosystem, foreign firms were extremely happy to be in China—making China the factory of the world. To exploit those benefits, they often pursued the corporate strategy to source components and services from Chinese manufacturers to increase competitiveness—for the purpose of maximizing profits. For example, Apple does not produce a single tangible component to make its iconic innovation, the iPhone. More than 200 suppliers, mostly spread across Asia, supply components to Foxconn to assemble them together, by placing a seal—Made in China. Through such strategy, Apple just pays $357 to component makers and assembler to rack $642 dollar from the price of $999 of each iPhone X—180% markup for the intellectual assets residing in Apple’s software, and overall design of the product. In absence of Chinese firms’ superb capability of technology absorption leading to high efficiency and quality, Apple could have not been successful in showing such a remarkable success story. As reported by Forbes, the cost of iPhone could have been in the $30,000 to $100,000 range, if Apple were forced to make it in the USA. Certainly, such cost could have not allowed Apple to rack so much money for the US economy from all over the world. It is not only Apple, many American, European and Japanese firms are also succeeding in this underlying capability of Chinese firms.

Is eroding core competence raising intellectual property infringement issues?

Through the process of exploiting benefits from the specialization, and scale and scope advantages of suppliers, most of the foreign firms have lost certain competencies to their suppliers. With the given situation, if Chinese firms source components from those suppliers and assemble them to make, or re-innovate to be politically correct, products, which are similar to ones produced by foreign firms, is it impartial to take measures to stop it? For example, Chinese makers like Oppo, Vivo or Xiaomi are offering smartphones, similar to Apple’s ones. These Chinese firms are often sourcing components from the same suppliers, who are also suppliers to Apple. Sony has been the preferred supplier for all smartphone makers, including Apple, for smartphone camera sensors. Upon loading the improved version of freely available Android on devices, assembled from components of numerous suppliers, Chinese firms have succeeded to take away market share from Apple. And Apple is not an exception. Firms in the business from the wind turbine to bullet train making are losing the market shares to Chinese firms, due to the rapid technology absorption of local firms and the expansion of indigenous suppliers’ network. Upon experiencing such a reality, there has been a call for taking actions against the allegation—“Forced technology transfer practice of China.” There is no denying that there may be the certain truth, but it’s also a reality that sensible business practices for maximizing profit are empowering Chinese firms to acquire increasing technology capability. It is also welcoming because such progress helps consumers to get better quality products, at a lower cost. It would be naive to perceive that China should not benefit from learning.

Is it wrong for Chinese firms to upgrade from labor suppliers to innovators?

The expectation that China will remain as just a labor supplier to replicate products for foreign firms and to continue to be a buyer of products of those firms may be very naïve. Yes, many countries have done that. For example, Bangladesh has been stitching shirts for foreign brands as per given specifications, by importing recommend machinery. Bangladesh neither developed global brands nor acquired the capability of absorbing and producing textile and apparel making machinery through the process. Similarly, Malaysia has been assembling and testing electronic products for decades, without making any headway in designing and producing them on their own. Even India’s export success story of IT service could not uplift service-exporting firms to IT innovators. Nevertheless, that does not necessarily mean that Chinese firms would not aspire and succeed to migrate from labor suppliers to be innovators.

Instead of protection, speed up innovation

Well, what should than American or other foreign firms do? Should they just silently observe the handover of innovation glory from them to Chinese firms, considering many of them once were their partners or component suppliers? What should the role of Governments be? Should the powerful US Government silently ignore the fact that American firms are losing in the global innovation trade due to the uprising of Chinese innovations? Well, of course not.

It seems that trade advisors have a bagful of interventions of retaliatory measures. These measures extend from increasing tariffs to the embargo, to limiting the flow of risk capital finance to American start-ups. All these measures are geared to throttle competition and slow down economy. But there is an alternative. No technology product is static. They are amenable to improvement through the progress of underlying technologies. By focusing on this key area, the US succeeded in enjoying significant economic prosperity during the second half of the 20th century.

Listen again- the message underpinning USA’s Science, Technology and Innovation lead

Paying heed to Dr. Vannevar Bush’s argument made to President Roosevelt, “we cannot open endless frontier of growth…merely by making the same things we made before and selling them at the same or higher prices”– since 1945, successive US government’s consistently supported R&D to speed up innovations. Unfortunately, the US’s leadership in R&D has slowed down in the recent past. Moreover, intellectual assets such as patents which are being granted to accelerate innovation, are often being used to slow down innovation. US firms can easily get rid of their fear of the erosion of competitiveness by speeding up innovation firms. Moreover, additional momentum which is being brought by Chinese firms has the potential to serve the interest of American firms, as opposed to hurting them. It’s time for trade pundits to look for ways to speed up innovation as opposed to slowing down to stop the escalation of US-China trade row. An alternative to retaliatory tariff measures could be to speed up innovation so that the technology edge of foreign firms lost to Chinese counterparts could be regained. Obviously, China should redouble the effort to catch-up—accelerating the speed of innovation.

*The writer is an academic, researcher, and activist: Technology, Innovation, and Policy. He can be reached at e-mail: zaman.rokon.bd@gmail.com