Dhaka Bank emphasizes the necessity for human resource in order for the bank to flourish, could you elaborate upon this idea? How does Dhaka Bank maintain an efficient workforce?

Human resources are considered to be the most important asset to any organization but very few organizations are able to fully harness their potential. Banks struggle to find talent while facing the threat of their top professionals leaving. In order to develop our human resources, we have taken a number of initiatives; these include continuing education and on the job training, IT orientations, career development, and counseling. At present, the service quality of banks is an important factor in order to survive in the banking markets due to domestic and global competition. There are prerequisites to receiving quality services in banking which include the placement of the right people with skills, abilities and right knowledge of banking services, in offering services to clients which have a direct positive impact on customer services. We implement 4 strategies in order to attain this:

– Talent acquisition: we use the term Talent Acquisition (TA) and not recruitment. TA is a strategic approach to identifying, attracting and bringing out the most talented to efficiently and effectively meet business needs. Dhaka Bank sees recruiting as a subset of TA, which includes activities of sourcing, screening, interviewing, assessing, selecting and hiring.

-Compensation: our bank maintains an equitable remuneration structure that recognizes the employee contributions and reward performance facilitating high levels of motivation and retention; setting the standards for disciplined management of human capital risk also entails developing incentive and reward structures that reinforce Dhaka Bank’s culture.

-Training and development: we realize that human resources working in banks must be equipped with ICT -based knowledge, skills and competencies. The banking industry is a knowledge based industry. The knowledgeable and well-equipped employee is essential to successfully operate the business.

– The millennial generation: we want to focus on employing millennial as employees as they are best equipped to understand the needs of their generation, and can develop convenient solutions that fit their lifestyles.

With so many banks as options for customers, how do you attract customers and address the competition?

Banks are finding new growth opportunities through online and mobile channels, proving once more that consumers are increasingly attracted to the convenience and speed of mobile and online solutions. Knowing consumer trends will help Dhaka Bank understand how to position itself in an increasingly mobile reality. Delivering superior service quality to customers in today’s business environment is very crucial and important due to the stiff competition. Dhaka Bank’s ability to provide high service quality will strengthen its image; enhance retention of customers, attracting new potential customers through customer satisfaction and loyalty programs. The Central Bank’s decision to allow licenses to new banks has the merit. A logical argument can be made beyond the unbanked population argument that more competition will improve service quality and ultimately will benefit the consumers. While most banks offer similar commodity type products, they are combating with each other in most cases on price/yield/turn-around time (TAT). Dhaka Bank, by focusing on service delivery (TAT), differentiates itself and gains ground on new entrants. Contrary to popular believe that aggressive marketing or in this case aggressive lending may help quickly capture market share and drive banks’ profitability; in reality, the success of banks in the long-run depends on ensuring that they lend to the right clients. Most of us are aware of the negative result of aggressive growth in the lending portfolios. Dhaka Bank has one of the strongest corporate portfolios. This can be leveraged by means of Payroll Banking to create and capture a secured and sustainable retail portfolio.

Why is it important that a bank set up a Central Data Repository?

During the normal course of business, financial institutions collect valuable data about their customers and the markets in which they operate. This data includes customer demographics, historical and current banking trends, historical and current financial statements, business activities and plans, market trends and norms, as well as probable risk indicators and more. When a financial institution does not have a centralized data repository, data is saved in several independent data silos that are difficult if not impossible to integrate making it quite a challenge to obtain a complete picture of a counterparty, exposure or portfolio. Lack of a centralized data repository results in incomplete analyses and reduced quality for no reason other than the lack of a central system to retain relevant information. Consolidating data into a single information source gives your financial institution a significant edge. The financial institution will be able to obtain an up-to-date, accurate depiction of individual counterparties as well as portfolios from a single aggregated data source, without wondering if additional data resides elsewhere. The consolidated data repository solution will also make a huge contribution towards creating and maintaining risk scoring models. Credit and borrower scoring has become a mandatory part of the lending process. Maintaining a sound scoring system poses a serious challenge to banks, the greatest of which is perhaps the initial building and implementing of the scoring models. Maintaining a data repository will assist bankers in selecting risk scoring methodologies most appropriate for the types of data that have been captured. Furthermore, the more data captured, the more extensive the analyses may be. The benefits include:

• Improves business decisions

• Centralize the storage and maintenance

of data

• Improves Data quality and accuracy

• Reduces time-consuming updates and redundancies

• Maintains data history

• Generates a higher ROI

What are the necessities of generating a Management Information System (MIS) and FinTech in banking?

Banks have manifold functional systems. These usually include sales systems, call center, financial systems, inventory, logistic and more. MIS combines information from multiple systems. This helps management staff better understand their own departments’ contributions. In many cases, the combination of data, such as sales figures combined with available inventory, help the bank take the appropriate action in order to reach the right customer and meet their specific needs. Banks collaborating with FinTech for mutual benefit has long been the preferred narrative when discussing the future of financial services. Banks in Asia-Pacific are keenest to acquire FinTechs. 31% of banks said they view FinTechs as acquisition targets, while banks in North America were similarly keen, with 30% seeing FinTechs this way. Acquiring a FinTech provides banks with full control of the solution, enabling them to shape it to their specific needs, while also allowing them to market innovation under their own brand. From a FinTech’s perspective, a sale can be attractive because it removes the pressure of having to achieve profitability and scale independently in an increasingly crowded market. No firm is immune from the coming disruption and every company must have a strategy to harness the powerful advantages of the new FinTech revolution.

According to Boston Consulting Group (BCG), by 2030, 33% of Bangladesh will belong to the middle-class and this will change demands. What services are you creating in order to cater to this shift?

Bangladesh’s middle-class population is expanding rapidly. Substantial upward mobility among households at the lower steps of the economy is likely to assure that growth in Bangladesh’s consumer class will remain strong for decades. This growth will enhance buying power throughout the country. Currently, a majority of Bangladesh’s middle-class population is concentrated in two cities—Dhaka and Chittagong. Initially, most of the middle-class population growth will occur in Dhaka and Chittagong and will spread through the smaller cities of Bangladesh – thus having significant implications for business. Historically, the middle-class population has a tendency to save and Dhaka Bank is one of the pioneers in the industry in savings products of different types. Dhaka Bank will take full benefit of its distribution platform, product management, and capabilities to tackle the demand for the growing middle class

Studies have shown 2 important trends regarding MAC:

I. Customers are highly steadfast to brands, but they are also budget and quality conscious. Most Bangladeshi consumers work within a budget, and the price is often cited as the second priority over quality. Dhaka Bank will nurture its existing strong brand value to ensure a growing customer base.

II. Customers increasingly use the mobile Internet and a good portion of Bangladeshi consumers own Internet-enabled smartphones. Currently, most transactions are in cash, but the popularity of smartphones suggests that more consumers will be making the jump to mobile payment, creating an opportunity for reaching households through wireless mobile services. bKash is a prime example here. Harnessing IT innovation, Dhaka Bank will provide banking solutions via mobile applications.

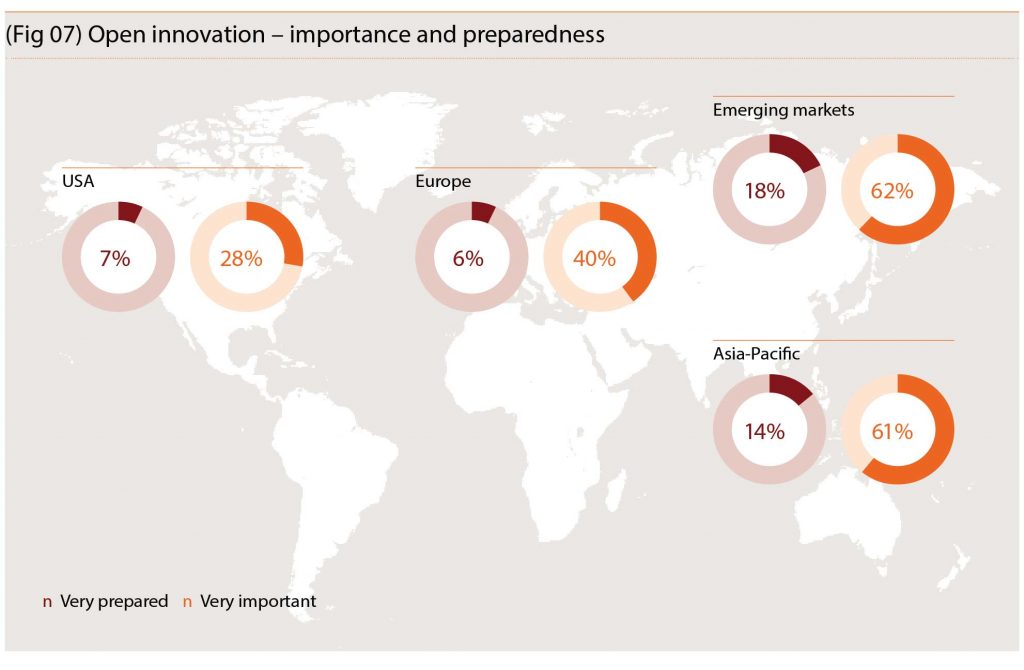

* Fig 06, 07, 09 courtesy of ‘Retail Banking 2020 Evolution or Revolution?’ (online version) from PwC Retail Banking 2020. www.pwc.com

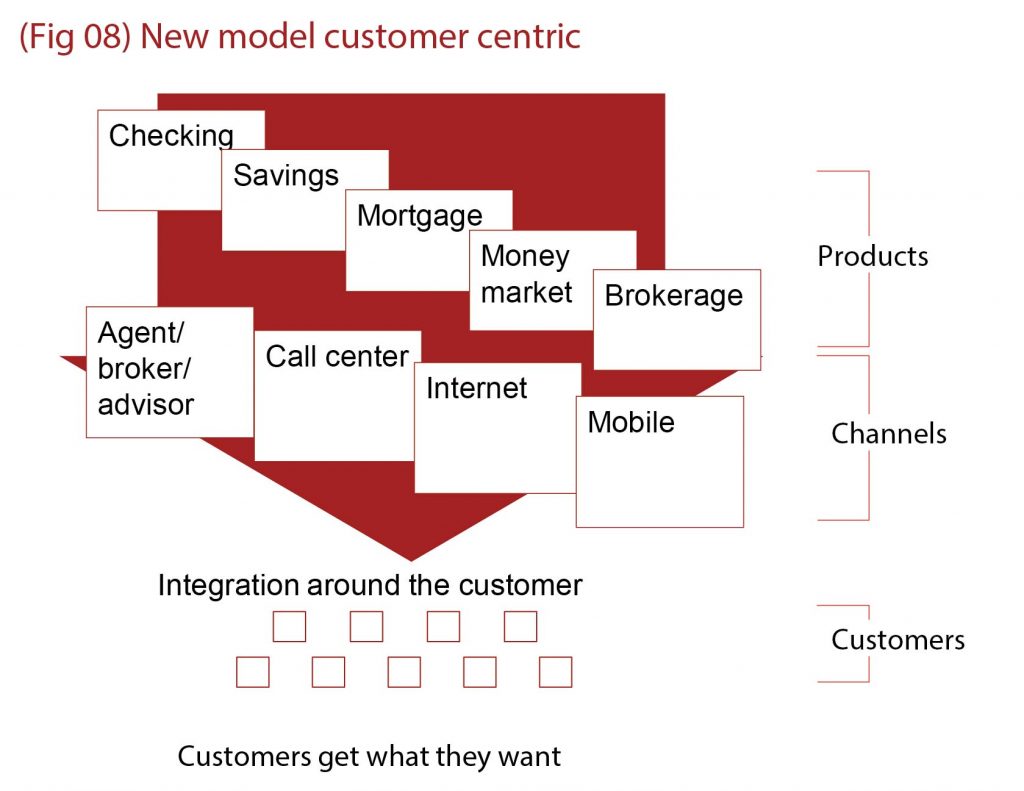

* Fig 08 courtesy of ‘Getting to Know You: Building a Customer-Centric Business Model for Retail Banks’ (online version), a publication of PwC’s Financial Service Institute (FSI).www.pwc.com