The largest take-private in history, the EA acquisition, is a Hail Mary that will either restore gamers’ trust in Electronic Arts or be the final nail in the coffin for the industry giant.

Electronic Arts (EA), a giant of the gaming industry, is on the cusp of a USD 55 billion acquisition. This deal, involving a consortium of investors, is indicative of an evolving dynamic of the gaming industry amid economic pressures and strategic realignments, with potential impact on business models and community engagements.

EA & GAMERS: A LOVE-HATE RELATIONSHIP

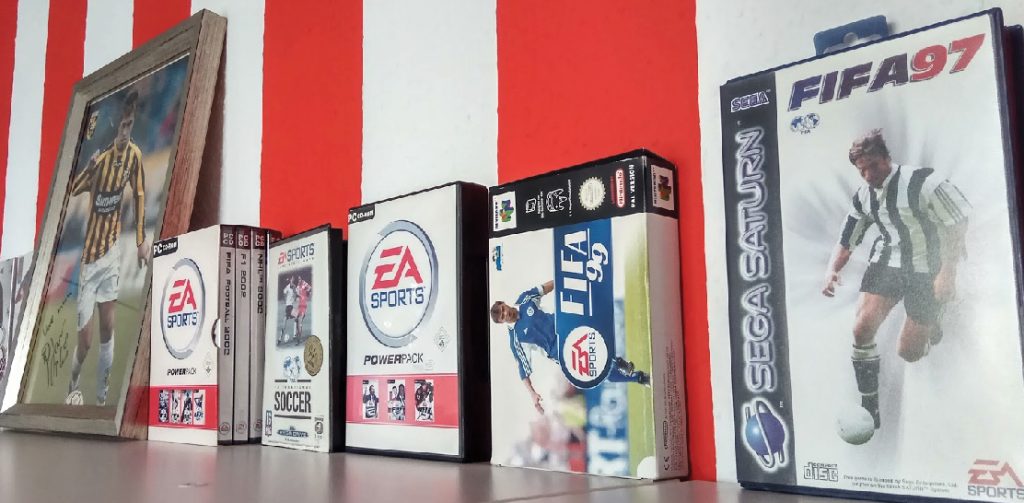

EA has long been a cornerstone of the video game industry, captivating global audiences with its groundbreaking franchises. Founded in 1982 by Trip Hawkins, the company quickly rose to prominence by treating games as a form of art and pioneering a developer-centric model that disrupted traditional publishing. Hawkins also adopted a direct-to-retailer sales approach, allowing developers to gain visibility and creative recognition.

Under Larry Probst, who became CEO in 1991, EA entered an era of console dominance, forging strategic partnerships with Sega. EA expanded into new genres — RPGs, simulations, and strategy games — while increasing its efforts to appeal to international markets. It worked. Fans around the world eagerly awaited EA’s annual franchise releases, knowing they would deliver completely new games from beloved series like FIFA (now EA Sports FC), The Sims, Need for Speed, Diablo, Battlefield, and Mass Effect.

When John Riccitiello took over in 2007, EA entered the age of mobile expansion. However, many fans argue this period marked a shift away from EA’s original creative spirit toward a profit-first mindset. The company became synonymous with microtransactions and annual franchise refreshes that offered minimal innovation. And then began the Andrew Wilson era.

Wilson took over as CEO in 2013, and from 2015 onward, EA found itself mired in recurring controversies. Between 2015 and 2016, it faced antitrust lawsuits over exclusive sports licensing deals. Between 2018 and 2019, EA drew widespread criticism for loot box systems that many likened to gambling. 2020 onwards – the pandemic years – while EA found some financial success through live-service games, technical issues and missing features in one of its most-hyped games, Battlefield 2042, eroded trust among fans — some say, irreparably.

By early 2025, EA’s stagnation was apparent, reflected in a 17% stock drop and growing discontent among gamers frustrated by its lack of innovation. Now, EA is set to be acquired by a Saudi-led consortium. The reactions remain mixed — some hopeful for a creative revival, others sceptical of what the future holds for one of gaming’s most storied publishers.

THIS TRANSACTION, THE LARGEST TAKE-PRIVATE IN HISTORY, INVOLVES SAUDI ARABIA’S PUBLIC INVESTMENT FUND (PIF), THE TECHNOLOGY-ORIENTED PRIVATE EQUITY FIRM SILVER LAKE, AND AFFINITY PARTNERS, ESTABLISHED BY JARED KUSHNER.

THE EA ACQUISITION

The acquisition story gained momentum in late September 2025, leading to EA’s formal announcement of a USD 55 billion all-cash deal to go private under a consortium of investors. This transaction, the largest take-private in history, involves Saudi Arabia’s Public Investment Fund (PIF), the technology-oriented private equity firm Silver Lake, and Affinity Partners, established by Jared Kushner. Shareholders are set to receive USD 210 per share, reflecting a 25% premium over the pre-announcement price, with funding comprising USD 36 billion in equity and USD 20 billion in debt from institutions like JPMorgan Chase. PIF, which already owns a 9.9% stake, will maintain majority control by rolling over its investment.

This development occurs against a backdrop of industry headwinds, as evidenced by EA’s second-quarter fiscal 2026 results. Net income fell 50% to USD 137 million, while net bookings declined 13% to USD 1.8 billion. Despite solid contributions from releases like Madden NFL 26 and ongoing support for Apex Legends — games highly popular in North American markets — factors such as restructuring expenses and deferred revenues have exposed underlying challenges. The deal is anticipated to finalise in the first quarter of fiscal 2027, around mid-2026, marking a pivotal shift for the company.

ARE THE DARK DAYS OVER?

EA’s executives portray the acquisition as an opportunity to propel the company forward, harnessing the consortium’s resources to innovate and expand. Wilson has suggested that the partners’ expertise in gaming, entertainment, sports, and their global connections could facilitate the integration of physical and digital realms, enhancing fan interactions. For PIF, the investment aligns with Saudi Arabia’s Vision 2030 initiative, which seeks economic diversification beyond oil by fostering sectors like gaming to generate employment and build supportive infrastructures. Silver Lake, with its track record in technology investments, has committed to substantial funding, praising EA’s growth trajectory under Wilson’s stewardship. In an era of gaming market slowdowns, transitioning to private ownership might allow EA to operate without the constraints of public market expectations, focusing on long-term strategies amid volatility.

From a business standpoint, the acquisition promises an influx of resources that could accelerate expansion efforts, including advancements in artificial intelligence and the creation of new intellectual properties. Freed from quarterly reporting obligations, EA may pursue ambitious projects with greater flexibility, potentially diversifying revenue through innovative hybrid experiences that blend gaming with other entertainment forms. For the gaming community, this could translate into richer, more immersive content tailored to diverse audiences, such as localised features for emerging markets like the Middle East. Enhanced support for esports and community-driven updates might strengthen player loyalty, ensuring sustained engagement with flagship titles.

The deal, however, is not without potential pitfalls. On the business side, the substantial debt component could necessitate cost reductions, including workforce adjustments, building on recent industry-wide layoffs at EA. Private equity’s emphasis on profitability might shift priorities toward immediate returns, possibly at the expense of research and development investments. For gamers, apprehensions centre on external influences potentially affecting content creation, with concerns about creative autonomy and the risk of altered narratives to align with investor interests. Labour groups, including Videogame Workers United-CWA, have urged regulatory bodies like the Federal Trade Commission to examine the transaction closely, advocating for safeguards on employment and studio independence. Broader discussions have touched on ethical considerations, such as the implications of foreign investment in cultural products.

FOR GAMERS, APPREHENSIONS CENTRE ON EXTERNAL INFLUENCES POTENTIALLY AFFECTING CONTENT CREATION, WITH CONCERNS ABOUT CREATIVE AUTONOMY AND THE RISK OF ALTERED NARRATIVES TO ALIGN WITH INVESTOR INTERESTS.

ENVISIONING EA’S PATH FORWARD

As EA transitions, the focus will likely remain on delivering transformative entertainment. Yet, the path ahead includes navigating regulatory reviews, which may scrutinise aspects like national security and antitrust implications. EA operations in key locations, such as Canada and Orlando, face uncertainties that could impact local economies and talent pools. The integration of advanced technologies like AI might streamline processes but could also lead to further job displacements, echoing patterns in creative industries.

This acquisition exemplifies the gaming sector’s maturation, where financial injections must harmonise with artistic integrity to sustain growth. The outcome could influence future industry consolidations and serve as a reminder that in the quest for progress, balancing commercial ambitions with community values remains essential for long-term success.