Trust In Tech: Why Banks Need Bring Their Services to the Consumers

Are banks keeping up with consumer demands when it comes to digital banking offerings? How can banks offer consumers the experiences that they want?

Research shows that 46% of people opt for a digital channel for banking, expectations are outpacing experiences at most organizations. Consumer banking habits have continued to evolve, and users have many choices for how and where they bank. New devices and digital banking tools give consumers the convenience of banking on the go, but the traditional banking center still has plenty of fans for certain kinds of transactions. In a Digital Banking Consumer Survey, we look beyond this split to see how firms can serve the needs of today’s consumers. One conclusion: banks need to think “mobile first” to win in this market.

We’ve seen some clear preferences with respect to channels and goals. In some cases, the trends aren’t surprising, but there’s a gap between what consumers want and what they’re getting from their banks.

Among the various types of incentives, we studied, for example, results showed that more than half of customers would be willing to switch to low-cost digital channels if they were given positive fee-based incentives – such as increasing interest rates on current deposits by 0.25% or decreasing interest rates on current loans by 0.25% – or positive incentives that enhance the functionality of digital channels – such as ATMs that allow live video interaction with tellers. Given a choice between these two types of incentives, customers prefer fee-based incentives. More than 70% of customers would be willing to switch to digital channels if offered fee-based incentives, while incentives that enhance functionality were less effective.

Do you believe that banks have engaged the trends of banking online?

Banks have realized that the cost of transaction drastically reduces from the brick and mortar structure of the branch to online delivery channels like ATM, POS Terminal, Mobile Phone, Internet, etc. Each of these channels has its own specific advantages in terms of improved customer service and reduced transaction cost. The basic difference between online banking and traditional banking is that in traditional banking, the customer has to visit the branch for the basic banking needs viz. withdrawal or deposit of cash, transfer of funds, statement of accounts etc. Online-business saves customers’ time. Bank also enjoys lower overheads, establishment, premises and maintenance costs, which results in a reduction of transaction cost. Low transaction cost is one of the main reasons why online business is getting popularity. The worldwide transaction cost of ADCs is decreasing as the number of online (branchless) transactions are increasing very rapidly.

How can banks utilize digital interventions to market their services?

Each of the ideas we are following can affect how financial institutions market, sell and deliver their services. With mobile banking, for example, online-dominant consumers are becoming mobile-dominant consumers—and everyone else is shifting that way, too. Last year, we saw the rise of “omni-digital” consumers: those who prefer to interact with their bank digitally, without a preference for using a laptop, a tablet, or a smartphone. However, we currently see that a clear preference has been forming, and the smartphone won the contest. We have further observed how people choose their primary bank, as well as the other firms they use for deposits, borrowing, and investing. It turns out that, while convenience is important, people value other attributes and these offer openings to providers who want to step up their game in a non-core market.

We have a more comprehensive understanding of why customers keep visiting branches, and that points to some strategic implications for how banks can manage their footprint and control costs. We have witnessed that people appear less “engaged” with their financial providers. This may not be a bad thing, but it does highlight just how little some banks know about their users. Finally, we’ve looked at the goals that drive banks’ customers, and where users really need support.

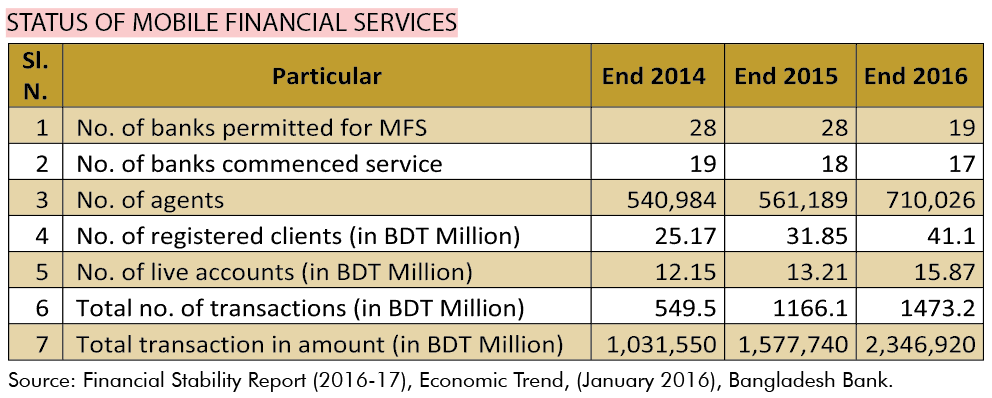

Bangladeshi customers are now able to do banking from any place of the globe at any time by using Internet technology. At the end of 2017, about 68% of banks were able to provide some sort of Internet banking services in Bangladesh, which was 64% at the end of 2016. In December 2015, it was 60%, showing a 4% growth compared to 2012 (57%). Amount of money transferred by this channel is shown in the following graph.

How should banks improve their communication on these platforms?

The most effective way to understand and bring the organization from traditional banking to digital banking is Omni-Channel approach. Omni-channel is a multichannel approach to customer service where all the channels are tightly integrated, keeping the customer at the center of the integration. As customers continue to change their channel usage patterns, banks and credit firms need to focus on delivering a seamless customer experience across various touch points. More than just an axiom, Omni-channel banking is a prospect to take the bottom-line on a higher note by gaining insights from customers’ channels, behavior, and preferences. Today’s customers are more sophisticated and tech savvy, and to cater to their specific needs, each customer needs a unique experience from banking. They want the companies to understand their unstated needs as well as their likes. So, it should come as no surprise that these customers are expecting a similar kind of response and service from banking institutions too. From researching new services, opening an account, checking balance, conducting transactions, loans, credits, wealth management, customer support, delivering an Omni-channel experience has become a key to success in this competitive marketplace.

Imposing charges and restrictions to move customers to digital channels that they don’t prefer, in contrast, is unlikely to yield positive results. Our analysis showed that half of all customers will look for another bank if fees are imposed (for example, if the bank increases interest rates on current loans by 0.25%). More than one-third of customers will look for another bank if their bank imposes procedural restrictions; for example, shortening operating hours for branches or call centers. Again, customers react more strongly – and in this case, negatively – to fee-based disincentives than to other types of disincentives.

Do you conduct penetration testing? Why has it become essential for banks?

The financial services industry has unique information security requirements. Frequently the target of attacks, banks have to perform a higher level of due diligence to ensure the confidentiality, integrity, and availability of customer transactions. Penetration testing is one way to stress the attack surface that an organization presents to the outside world. Dhaka Bank IT division also performs penetration testing every year to find out the vulnerabilities in the bank’s technological upbringing and judge the exposures they are rendering in the overall business perspective.

“Penetration Testing” or “Ethical Hacking” is the process of identifying vulnerabilities in the bank’s technology environment and assessing the exposures they create. This is performed in the same way as a malicious attacker would, with the same techniques and tools, however, without the malicious intent. It allows the enterprise to understand the level of exposure that it has to the various forms of attack and is the only real test that uncovers hidden vulnerabilities. It is a convincing tool in planning remediation activity and security spend effectively. It is important to understand that not all attackers are actually persons; in fact, the majority of attacks today are facilitated by automated technologies and malicious software agents that have been specially created to exploit common known weaknesses. These attacks are arbitrary in nature and attack everyone and anyone with a vulnerable connection to the internet, regardless of who they are or what data they have.

Could you detail the difference between External Penetration Testing and Internal Penetration Testing?

“Penetration Testing” is typically associated with the process of attempting to identify and exploit vulnerabilities on externally facing systems. However, different penetration testing exercises address different threats.

External Penetration Testing: The focus of this testing is to assess whether someone outside of the organization is able to access core information assets from the internet through weaknesses of bank’s perimeter.

Internal Penetration Testing: The objective is to assess whether internal staff or someone with access to the bank’s physical premises can access information assets they are not privy to.

Web Application Security Assessment (WASA): The focus of this exercise is to assess and identify what vulnerabilities can be exploited through web applications and services made available to clients, employees, etc. Such vulnerabilities may allow an attacker to exploit the application and extract its data or to further elevate their privileges.

To make the most of a penetration test it is necessary to prioritize the engagement. There are six major areas to which penetration testing applies:

i.) the network is typically scanned to identify the network addresses of all target hosts (firewalls, servers, routers, essentially all live devices) connected to the network. Vulnerability scanning precedes the penetration test and will determine the network topology of the target environment, type of operating systems discovered, open ports and services, and a list of potential vulnerabilities.

ii.) The network perimeter devices like the border router are continually scanned by attackers looking to exploit a new vulnerability.

iii.) Wireless devices also present a potential entry point. Penetration testing will reveal any configuration or implementation errors.

iv.) Web-based applications should be penetration tested as they represent a high-risk attack surface that attackers are continuously probing.

v.) Commercial software should also be penetration tested as this represents a risk of exploit by insiders.

vi.) In-house developed applications should be tested as they can also provide an entry point for an attacker.

All six of these areas must be considered within scope for the penetration test.

Although the organization may have invested in significant security safeguards, a penetration test carried out by an independent third party can provide assurance that the safeguards in place are effective and thus protecting the organization’s reputation with customers, business partners and regulators – ultimately acting as a business enabler. A penetration test can also address specific compliance objectives in regulated sectors and help the organization’s IT department to take the necessary corrective measures (e.g. by patching vulnerable systems) and ensure continuity of critical business operations that rely heavily on IT systems.

Why is it imperative for banks to recognize and work with IT interventions?

Information Technology, a revolutionary force has not left the banking sector untouched. The business operations in the banking and financial sector have been increasingly dependent on the computerized information systems over the years. It has now become impossible to separate Information Technology (IT) from the business of the banks and the financial institutions. In the last 15 years, a tremendous growth is seen in the digitization of the banking sector of Bangladesh. Government initiatives to develop a ‘Digital Bangladesh’ also boosted up this process highly. A recent study of BIBM shows that investment in IT has raised the efficiency of banks over time in Bangladesh regardless of their ownership. These gains in efficiency have also improved the bank’s productivity and profitability. Still, efficiency and profitability of state-owned and nationalized banks are less compared to other groups. As many financial products and services directly or indirectly depend on ICT, banks have to think how to involve IT to minimize the cost, increase the efficiency and how to provide better services to the customers ensuring reliability, safety and security. There are several basic requirements for ICT which must be met; these include a sound technical infrastructure, efficiency of the employees, and interaction with technical developments. Moreover, IT security and governance must be ensured for next-generation online banking in Bangladesh.

THE FOCUS BEYOND FINANCE

There are three major trends or challenges identified that the banking industry must respond to:

1. Improving Digital UX. There will be a shift from digital quantity to digital quality, as it applies to improve the aesthetics and simplicity of existing digital offerings.

2. Improving Digital Onboarding. While digital capabilities overall have improved, the ability to sell and onboard consumers on digital channels has lagged.

3. Improving Response to New Technologies. Organizations will need to be prepared to deliver an improved customer experience across new devices using new data insight capabilities. The ability to leverage Open APIs, AI and IoT are all part of this equation.

10 Ways to Improve Digital Banking CX

· Move from Functional Quantity to Design Quality

· Create Seamless Multichannel Experience

· Provide End-to-End Digital Onboarding

· Enhance Mobile Selling

· Use Insights to Meet Unmet Needs

· Remove Internal Silos

· Deliver Next-Gen Customer Support

· Increase Customer Value with Open Banking

· Combine AI with IoT

· ‘Future-Proof the Organization