Tanzim Alamgir, Managing Director of UCB Investment Limited, shares insights on driving growth, navigating challenges, and shaping the future of investment banking in Bangladesh.

Tanzim Alamgir is the Managing Director and CEO of UCB Investment Limited, the wholly owned investment banking subsidiary of United Commercial Bank PLC (UCB). When the institution was formed in October 2020, he was brought in to translate UCB’s vision into reality. With the support, infrastructure, and dedication of the UCB Group, in just five years, Mr. Alamgir has led UCB Investment Limited to the top, establishing it as the leading investment bank in Bangladesh.

Managing Director & CEO,

UCB Investment Limited

How has UCB Investment’s founding vision guided the institution’s journey since its inception?

Our simple yet ambitious vision is to ensure that UCB Investment Limited provides its clients a 360-degree investment banking platform. We have always aspired to be the one-stop destination for IPOs, bonds, M&A, loan syndication, structured finance, portfolio management, and more. To realise this vision, we invested heavily in human capital, building a strong and dedicated team comprising members with specialised expertise across the full spectrum of financial products.

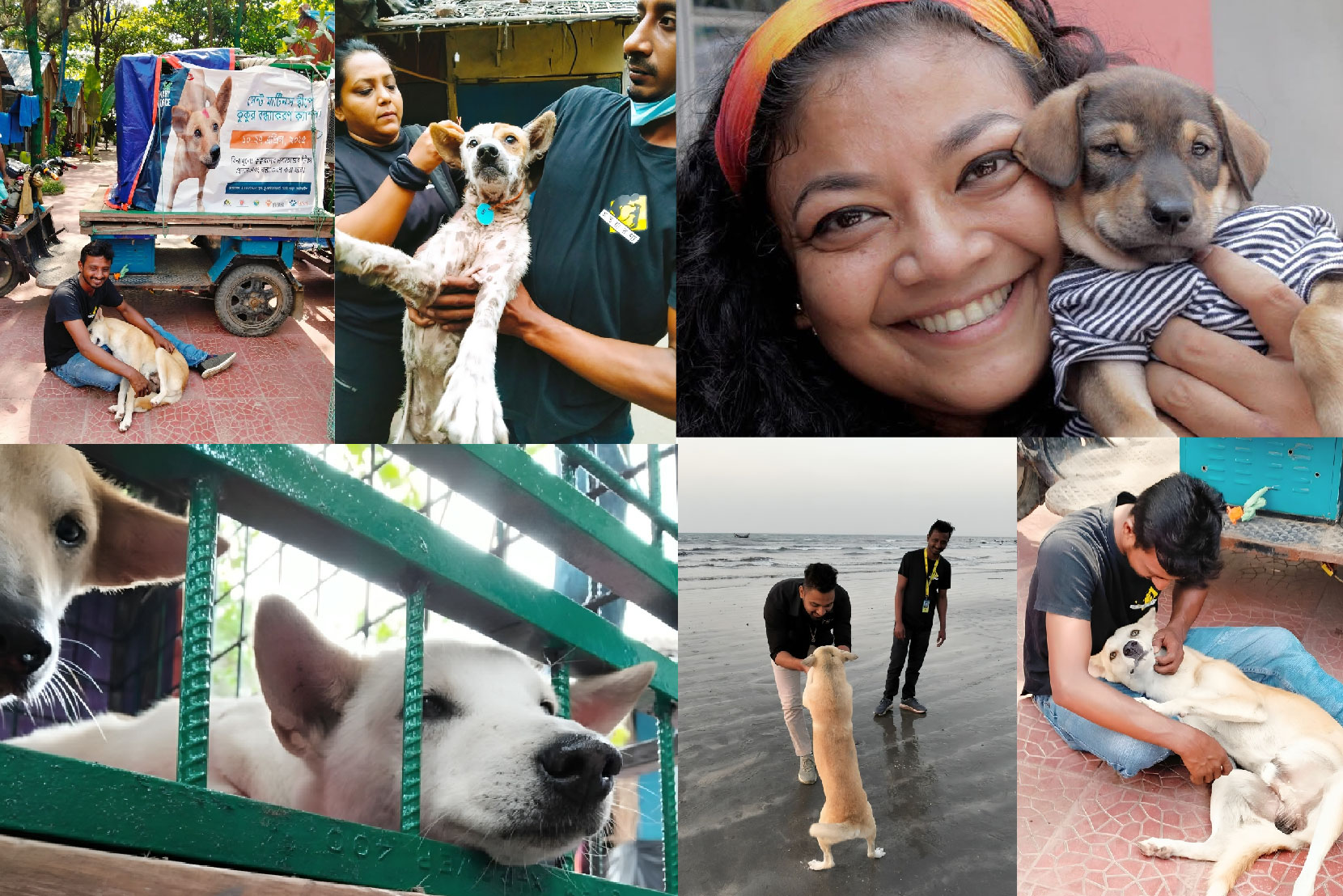

To us, growth is not just financial. Our initiatives, like ‘Decode Investment Banking (DIB)’ to promote financial literacy and Investing in Society (IIS) to support children’s health, women’s empowerment, and senior citizens, reflect our belief that an investment bank must serve not only markets but also society.

Our founding vision has translated into tangible achievements. In less than five years, we have executed 63 transactions, raising nearly BDT 170 billion. In this timeframe, we have advised 50% of the bonds listed on the Dhaka Stock Exchange (DSE). Today, UCB Investment has both the Best Equity Capital Market (ECM) House and Best Debt Capital Market (DCM) House in Bangladesh, as awarded by FinanceAsia, Euromoney, Asset Triple A, and many more.

What key factors have fueled UCB Investment Limited’s rapid rise in Bangladesh’s investment banking sector?

A major success factor is the unwavering support of United Commercial Bank PLC (UCB) and the strong foundation, reputation, and ecosystem of the UCB Group as a whole. The synergy between us and our sister concerns, UCB Stock Brokerage Limited and UCB Asset Management Limited, enables us to deliver truly one-stop solutions.

A cornerstone of our success is the “2S Philosophy – Strategy and Success”, which, five years in, has now evolved to what we call a “TriCore Philosophy” of “Strategy, Service, and Standard”, ensuring every mandate is guided by a clear strategic vision, client-centric execution, reflecting our commitment to consistency, transparency, and excellence.

Finally, our growth has been underpinned by financial discipline. Guided by our principle of the ‘three zeros’ – zero negative equity, zero receivables, and zero provision shortfall – we have built resilience and credibility. This has not only protected our balance sheet but also allowed us to deliver consistent results in both equity and debt markets, reinforcing client trust.

UCB Investment Limited’s discipline in research is why, even when much of the investment banking and brokerage industry is struggling with negative equity and provision shortfalls, we remain free from negative equity and continue to maintain more than 100% provision.

What were some of the challenges in the early days of UCB Investment Limited?

UCB investment started its journey in the middle of the COVID-19 pandemic, when businesses were cautious, investors were hesitant, and capital raising had slowed dramatically. The Russia-Ukraine war brought new uncertainties, and soon after, prolonged floor price restrictions in Bangladesh’s secondary market eroded investor confidence. Besides these external challenges, the investment banking industry itself was already saturated, with 65 licensed institutions, each specialising in specific services.

Our ambition was not to specialise in just one area, but to excel across all of them. We leaned heavily on research, conducting in-depth, sector-specific studies to identify opportunities with growth potential, adapting quickly whenever demand shifted between sectors or products. We use the same approach in our portfolio management, constantly rebalancing based on insights. UCB Investment Limited’s discipline in research is why, even when much of the investment banking and brokerage industry is struggling with negative equity and provision shortfalls, we remain free from negative equity and continue to maintain more than 100% provision.

How do you see UCB Investment Limited playing a role in unlocking the investment banking sector’s full potential?

Bangladesh’s capital market is brimming with potential, but it requires depth, trust, and education. For the capital market to flourish, investment banks must work collaboratively to ensure that both issuers and investors see the market as their first choice for long-term financing. UCB Investment Limited is facilitating that connection, helping companies raise funds efficiently, and guiding investors toward sustainable opportunities.

Beyond our daily work with clients, we regularly collaborate with the Bangladesh Securities and Exchange Commission (BSEC) and the Dhaka Stock Exchange (DSE) through national-level seminars and workshops that bring together policymakers and industry leaders. For example, we played an active role in the seminar on ‘Unlocking Bangladesh’s Bond & Sukuk Markets’ jointly organised by BSEC and DSE, and the ‘Workshop on Orange Bond Initiatives for Empowering Women’ hosted by BSEC – initiatives aimed at strengthening Bangladesh’s capital markets and promoting sustainable financing. This is particularly important because our economy is still predominantly money-market driven. If Bangladesh is to achieve its aspiration of becoming a USD 1 trillion economy by 2040, the capital market must play a central role in providing long-term financing of infrastructure development, industrial expansion, and large-scale projects.

What is your vision for the next five years of UCB Investment Limited?

Our vision is to take UCB Investment from being the leading investment bank in Bangladesh to becoming a regional player in investment banking. In 2024, we already received regional awards for landmark deals, and we want to build on that momentum, facilitating cross-border financing arrangements for both local and foreign entities.

We are also deeply committed to shaping the startup and technology-driven ecosystem. Our sister concern, UCB Asset Management, is the fund manager for two funds of BDT 1,500 million each for private equity and venture capital. We aim to channel these funds into high-growth startups.

Sustainability will remain central to our growth. We have an ESG Committee internally to embed sustainability in our operations, and on the business front, we are acting as the arranger and advisor for the country’s first-ever Orange Bond. Going forward, we will focus more on green, Sukuk, and thematic instruments that align with Bangladesh’s development priorities.

Finally, we will continue investing in technology, research, and people, ensuring agility in a fast-changing financial landscape. Most importantly, we see ourselves as partners in nation-building. As Bangladesh advances toward its next phase of economic development, UCB Investment will be there, not just as an investment bank but as an institution shaping markets, nurturing entrepreneurs, and contributing to society.

Photograph by Shihab Mohammad