By Zahedul Amin and Mahir Abrar Nikhat

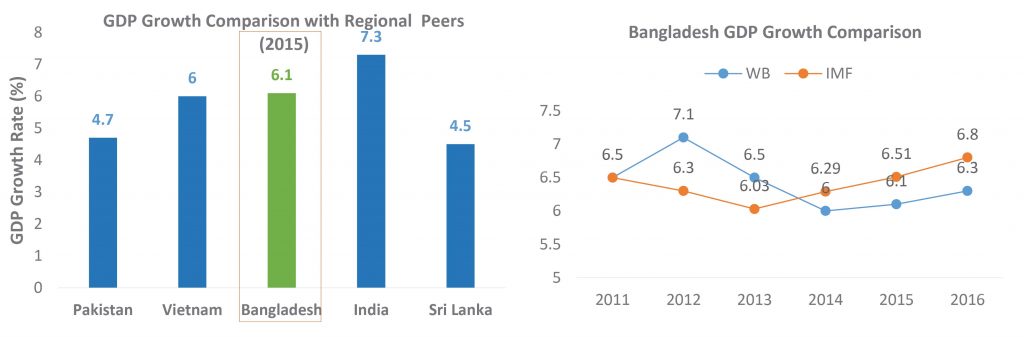

Bangladesh’s economy has achieved remarkable growth on the back of rising RMG exports, steadily increasing remittance flows, and growing domestic demand for goods and services. Bangladesh’s average growth of 6.2%, over last one decade, has been remarkable considering the series of internal and external shocks impacting the economy. From the global financial crisis in 2008 to a series of political uproars in 2013-15, the economy has successfully weathered the storm and is well on course to achieve the middle-income status. Due its growing nature, the impact is already being felt in terms of declining levels of absolute poverty level (31%), with Bangladesh successfully attaining the lower middle-income status in 2014.

Bangladesh’s geo-strategic location in the vicinity of India and China also puts further credence on the argument that the country’s economy will thrive in the future. With the recent visit of the Chinese premier, and promises of up to $24 billion in investment, Bangladesh’s private sector and policymakers have reasons to be optimistic about what lies ahead. The country is also part of the much talked about ‘silk route’ initiative, which looks to maximize regional trade and investments. Bangladesh’s immediate neighbor India, has also invested in the country’s future, through its $2 billion loan lines and joint venture infrastructure deals.

Bangladesh’s geo-strategic location in the vicinity of India and China also puts further credence on the argument that the country’s economy will thrive in the future. With the recent visit of the Chinese premier, and promises of up to $24 billion in investment, Bangladesh’s private sector and policymakers have reasons to be optimistic about what lies ahead. The country is also part of the much talked about ‘silk route’ initiative, which looks to maximize regional trade and investments. Bangladesh’s immediate neighbor India, has also invested in the country’s future, through its $2 billion loan lines and joint venture infrastructure deals.

Population a Boon for Progress

Bangladesh’s population has long been viewed as a liability. But with a growing population, the average age of the population has tilted to 23.4 years, with 60% of population below the age of 30, and 2.2 million people entering the job market each year. Utilizing this population segment is of paramount importance for the country to reach its 8% growth target in the coming years. In order to put these resources to use, the country needs to inject more investment, both from local investors and foreign investors. These large scale investments, preferably in the secondary sector, will boost employment. As a result, the idle resources will help accelerate growth.

According to the World Bank and Bangladesh Bank statistics, a country’s GDP to investment ratio should ideally be around 32%. Bangladesh’s GDP to investment ratio has historically hovered around 27-28%, mainly due to large savings-investment gap, overall lack of business confidence, and scarcity of land and utility connections. The country’s FDI level has also remained stagnant.

Views from the Private Sector

Entrepreneurs and top level executives from different organizations cutting across different sectors, play important roles in channeling investments. Their views are crucial in gauging the current business climate and future investment and growth prospects. In order to understand the pulse of the private sector, LightCastle Partners recently launched the Bangladesh Confidence Index 2016.

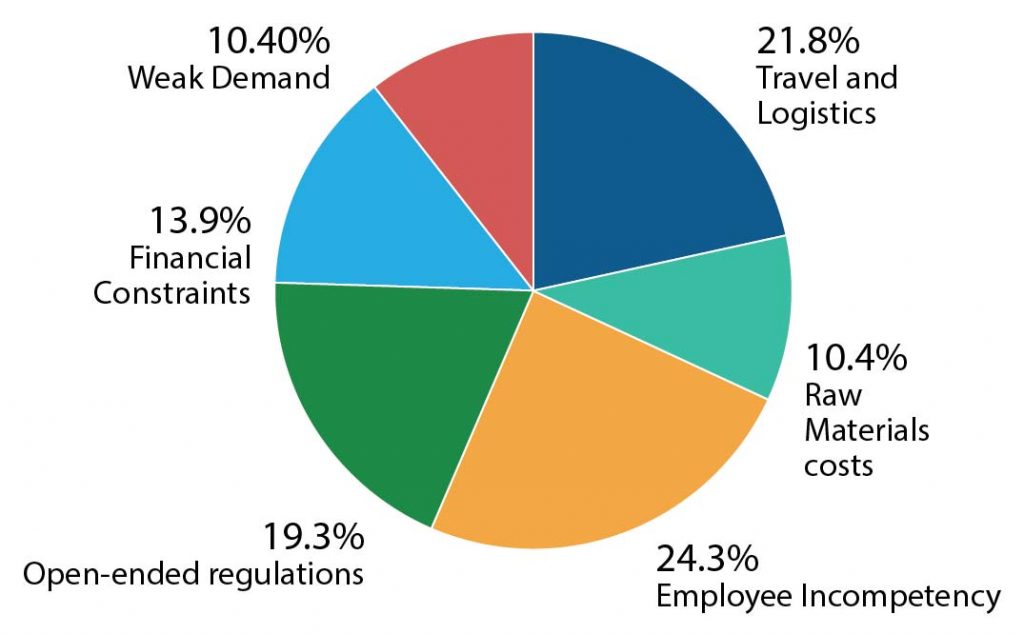

According to survey, infrastructure development has been identified as a major problem, which includes inadequate roads and highways along with insufficient power generation. There is also a gap in the quality of human resources and skill-sets required by employers. Alongside these issues, the lack of transparent rules and regulations has been creating problems for many industries e.g. FMCG.

Problem Areas cited by Industry Leaders

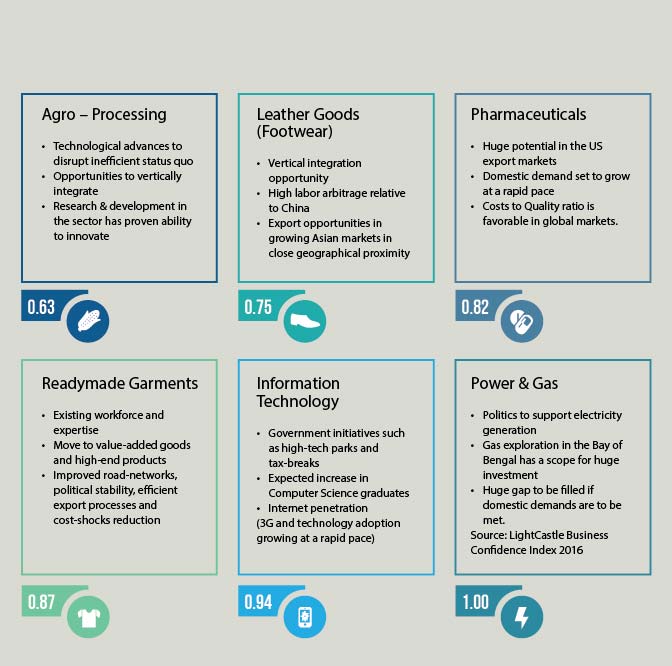

Opportunity Landscaping

Despite a number of complaints, representatives of the private sector are not totally bearish about the country’s economic prospects. They have identified a number of sectors which have the potential for growth.

How to Move Forward?

In order to achieve the middle-income status by 2021, the Government needs to create a business climate conducive to investment. Views of the private sector players should play an integral role in shaping the Government’s economic policies.

The newly formed BIDA must play an active role in weeding out red tape at all levels. Following Government’s Digital Bangladesh Vision, foreign investment process must be made transparent through digitization. Company formation procedures must be made hassle-free, especially for joint ventures and fully foreign owned initiatives. By placing maximum emphasis on secondary sector based investments, dedicated investment managers, appointed by BIDA, must be appointed to maintain close collaboration with potential investors. Another means would be to provide formal licenses to private sector firms, which would provide end-to-end solutions to foreign investors.

Private economic zones must be promoted and local private sector conglomerates must be encouraged for setting up private economic zones for foreign investors. Local investors must also be provided necessary utility connections for their factories on a preferential basis.

Investments must be channeled where it is most needed. Investments coming from Indian and Chinese Governments must be fully utilized for infrastructure development, as well as for government financed or PPP based power plants. The LNG terminal and coal based power plants would provide necessary wherewithal for the energy hungry economy and support future growth.

Economic activities should be disseminated across the country instead of focusing on solely the Dhaka and Chittagong regions. Local conglomerates must be incentivized to open up new factories in the less developed regions. This would not only increase development in those areas, but will help decrease regional unemployment rates and discourage migration to larger cities.

Bangladesh is at the crux of attaining middle-income status, and is already garnering attention from the World community. The World Bank has identified Bangladesh as an economic success. Regional economies are giving the vote of confidence by channeling investments within the country. As Bangladesh stands at this crucial juncture, it is imperative that the country gets its house in order by improving the overall business climate.

The time is ripe for Bangladesh to assert itself as a new emerging economic tiger.

Coauthored by Mahir Abrar Nikhat (Business Consultant) and Zahedul Amin (Co-Founder) from LightCastle Partners. They can be reached at info@lightcastlebd.com