In 2013, the International Renewable Energy Agency (IRENA) ranked Bangladesh as having the sixth-largest renewable energy-related workforce in the world; they estimated that the nation had 114,000 jobs within the sector. Ironically, only 60% of the country had access to electricity that same year, making it lowest of nine Asian Least Developed Country (LDC).

Five years after these findings, the time to invest in alternative energy is a long-neglected cause. In the backdrop of a depleting domestic natural gas reserve, it is a concern that an estimated 68% of electricity generation comes from this source. Imports of electricity (7% of total requirement) have reduced the dependency of costly liquid fuels. However, procuring alternative energy and creating power lines to import electricity should not be the only viable option that Bangladesh should explore. The nation is on the cusp of development in the coming decades and power to transmit sustainable growth is reliant on tapping into sources of alternative energy.

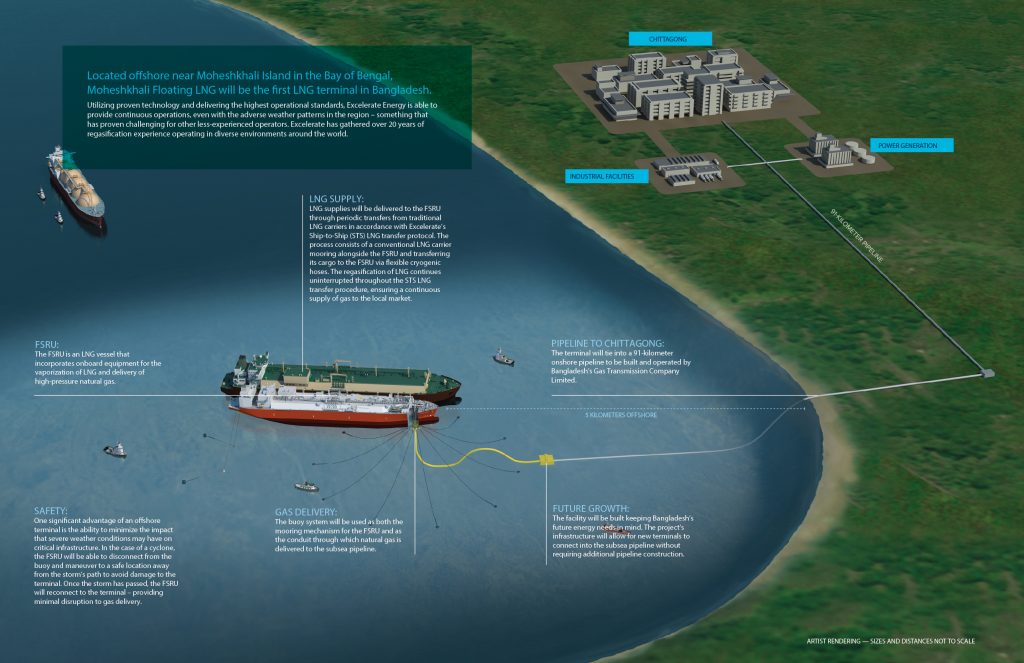

International Finance Corporation (IFC), has collaborated with US-based Excelerate Energy, and Petrobangla to tap into the potential of the liquified natural gas (LNG) as an alternative energy solution. The Moheshkhali Floating LNG (MLNG) project will be Bangladesh’s first LNG import terminal with the capacity to generate 500 million standard cubic feet of gas per day (MMscf/d). ICE Business Times opened a dialogue with Kamal Dorabawila, Principal Investment Officer, IFC and Wendy Jo Werner, Country Manager, IFC Bangladesh, Bhutan, and Nepal and Ramon Wangdi, Vice President – Business Development, Excelerate Energy L.P., on the groundbreaking terminal that will harness a new energy source.

THE CAPACITY OF FUNDING A LUCRATIVE PROJECT

The terminal is a pioneer project for Bangladesh as it will be the first of its kind to tap into the potential of LNG. Wendy establishes that the necessity and potential of this project drove IFC to become an equity and project development partner, “We had to be highly strategic and emphasize the foreseeable benefits of such a transformative project which proved to be difficult at first. LNG was new to Bangladesh and project financing for fixed infrastructure was new to the developer.” The project sought investors on an international tender basis which attracted very strong investors. These investors included Excelerate Energy, the largest floating LNG solution provider in the world. Wendy postulates that Excelerate Energy came into the project through an early stage project development tool at IFC known as InfraVentures, “When IFC typically comes into a project, we provide the equity, debt or both. In projects that require more support or a stronger partner to put the project together, we look to provide a greater role through IFC InfraVentures. In that sense, Excelerate Energy developed this floating LNG project with us as a co-developer. Towards that, we joined in the discussion with Petrobangla in order to establish the terms and conditions that were needed in the project concession agreements to ensure a balanced risk allocation that allows for the financing for the project. That allowed us to deliver a set of agreements that were bankable for international financiers.”

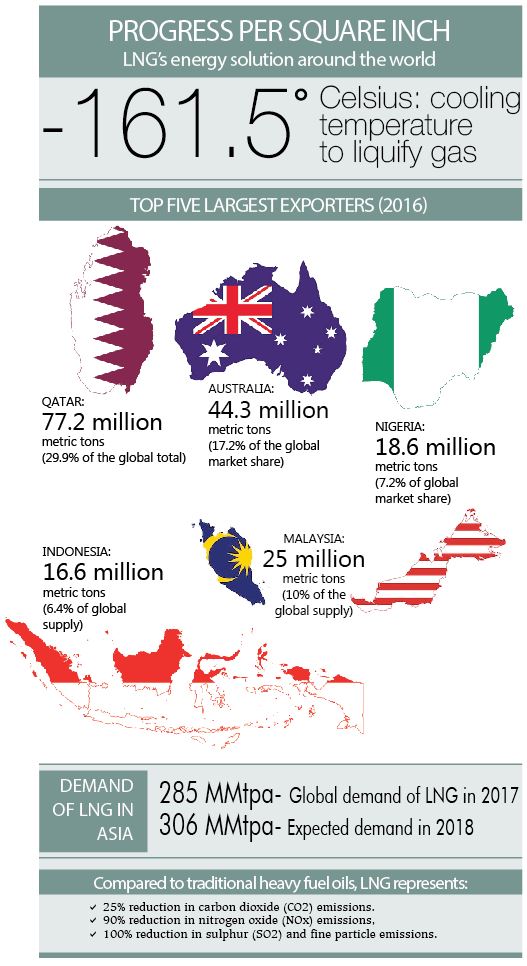

From a financial perspective, the project’s fixed infrastructure would cost approximately $180 million. However, Kamal explains that this does not include the larger picture, “Essentially we must look at the actual cost of the project in various components; we have the Floating Storage Regasification Unit (FSRU) which is a storage and regasification ship that is carrying out the major function. There is the fixed infrastructure that connects this FSRU to Bangladesh’s gas pipeline system and finally, there are port service vessels which provide operational support to the terminal as a whole. With the terminal located offshore, approximately five-kilometers off the coast Moheshkhali Island, some of the fixed infrastructure includes undersea pipeline with certain components anchored at the bottom of the seabed.” Global demand for LNG has seen tremendous growth in recent years, with global trade reaching 285 Million Metric ton per annum (MMtpa) in 2017; this market is expected to rise to 490 MMtpa by 2030 with Europe and Asia being the key centers for demand. Bangladesh is not far behind in this trend with some projections estimating that the nation would import up to 17.5 million tons of LNG by 2025.

STAGING YOURSELF AT THE NUCLEUS OF THE MATTER

Kamal and the team at IFC took on an unique role given the prospects of this project, “We have been quite active in financing power projects in Bangladesh but the lack of sufficient exploration for local gas and no recent large discoveries, coupled with the rapidly depleting domestic gas sources prompted us to use the IFC InfraVentures tool to help the early-stage development of finding ways to supplement domestic gas. In co-developing this project with Excelerate Energy, we became a 20% equity investor while arranging and providing the entire debt funding package.” IFC’s tremendous investment in the project is noteworthy; the organization arranged a debt package of $125.7 million including IFC’s own loans of $32.8 million and mobilized loans of $91.4 million, in addition to IFC’s equity investment of $10.8 million. The project and financing agreements IFC helped realize and IFC’s own funding went a long way to help put together the rest of the finances.

THE KINETICS OF AN UNRIVALLED COMPANY

Excelerate Energy, the chief sponsor of the project, began the floating regas industry through the delivery of its first FSRU in 2005 and by 2018 has transferred more than 150,000,000 m3 of LNG. Ramon associated the company’s trailblazing attitude to their global success today, “As the pioneer of floating regas technology and the global leader in the space, Excelerate Energy has accumulated a wealth of operational experience through its various projects – this includes providing over 30 years of collective regasification service days to its customers and having performed over 1,300 ship-to-ship transfer operations.”

The company’s infrastructure solutions act as a catalyst for markets, as it allows countries to access an abundant supply of natural gas from a variety of sources globally; throughout its history, Excelerate has performed regasification at 13 terminals globally, located in 8 different countries spanning 4 continents. Ramon believes that Excelerate’s business model, that focuses on developing innovative infrastructure solutions, has been extremely beneficial to the host country of each of its projects, “Projects such as MLNG provide our customers with certainty of gas supply, as it enables LNG to be imported from a variety of sources globally. Driven by this certainty of supply, investment in gas-dependent infrastructure downstream (e.g. gas-fired power plants, fertilizer plants, industrial plants, etc.), flourishes as investors are reassured their plants are able to be supplied with necessary energy and produce over the long term. In turn, the increase in demand downstream produces an economic environment conducive to increased exploration and production activities upstream, as countries explore for additional sources of fuel domestically.” In Excelerate’s experience, this circular process illustrates that LNG infrastructure solutions, such as MLNG, is often a crucial step for a country to propel its gas sector and broader economy forward.

The MLNG terminal comprises a purpose-built FSRU, which is specifically designed for offshore operations. The terminal utilizes state of the art regasification and fuel management technology, marine fixed infrastructure similar to other Excelerate facilities which have been permitted and tested in some of the most vigorous jurisdictions such as the Gulf of Mexico in the United States and brand new port service vessels which have also been purpose-built for offshore operations.

Excelerate’s FSRU – the Excellence – recently arrived at the site for the MLNG project to support the final stages of construction and pre-commissioning related activities ahead of first gas expected in June 2018. The MLNG terminal will deliver natural gas to Chittagong and the surrounding region for 15 years and beyond. With first gas occurring approximately 10 months from securing necessary financing for the project, the timeline for delivering MLNG represents an unprecedented achievement in the LNG industry – with traditional onshore LNG terminal taking between 3 to 5 years to come online following financial close.

PIONEERS OF THE PIPELINE

The MLNG project is slated to be the world’s first fully integrated turnkey floating LNG terminal whereby all services will be provided under a single contract by a single provider – Excelerate Energy. By streamlining the various components of the MLNG terminal under one contract, all responsibilities for developing, permitting, financing, constructing and operating the project rests with Excelerate. Ramon further explains that “Separating the procurement of the LNG fuel itself from the terminal, Bangladesh was able to evaluate a variety of options for procuring LNG in parallel with the construction of the terminal.” By employing this procurement model, Bangladesh was able to significantly reduce the timeline for introducing LNG into its energy system and enhanced its ability to receive LNG supply on flexible and competitive terms.

Ramon commends the government of Bangladesh for its tremendous support and foresight for this project, “Following the execution of contracts with the Bangladesh Oil, Gas & Mineral Corporation (Petrobangla) in July 2016, Excelerate Energy along with its partner, in the IFC, worked closely with the government of Bangladesh to establish a regulatory and institutional framework to not only implement the MLNG project but also to work as a blueprint for implementing LNG related projects in the country going forward.” By running the engineering and financing processes concurrently, Accelerate was able to deliver the project in less than a year following the receipt of all required permits and the securing necessary financing for the facility.

Excelerate predicts that Bangladesh’s economy will excel with the full implementation of the project. “Looking ahead, MLNG shall serve as the platform through which Bangladesh will be able to access an abundant supply of clean energy from the global markets for years to come, and thereby securing its future economic growth.”

CREATING FRICTION IN FUNCTION

When asked about the benefits of LNG for power generation over competing for fuel sources, Excelerate elaborated on the benefits being multi-fold:

· Environmental – Substantial reduction in carbon emissions from power generation when compared to liquid fuels (e.g. diesel) or coal

· Economic – Significant cost savings to generate power via LNG versus oil-based fuel sources. In addition to the lower cost of LNG vs. oil, it takes comparatively less volume of gas to produce the same amount of power compared to oil products due to advancement in gas turbine technology.

· Security of supply – When compared against alternative sources of gas (e.g. domestic production, pipeline imports) which may be disrupted due to geological or geopolitical factors, LNG is a truly global commodity which is produced from a variety of sources and exported by a diverse array of countries. Therefore, LNG ensures the certainty of supply for gas into a market.

· Flexibility – As LNG is easily stored and global trade becomes increasingly liquid, LNG is flexible enough to provide fuel to a variety of different power plants – ranging from baseload power plants which needs a constant supply of gas, to peak shaving facilities where gas is fed into the plant during periods of peak demand. This flexibility also makes LNG the ideal supplement to renewable sources of energy such as wind or hydro, due to the intermittent nature of renewable electricity generation.

UNDERSTANDING THE CURRENT BEFORE THE SHOCK

Natural gas research indicates that Bangladesh is highly likely to deplete its current natural gas reserves in 10 to 15 years. This posed a challenge for Kamal’s investment team, “We would be asked as to why an investor would want to fund a 20-year power project with the future scenario. At the same time, we needed to arrange long-term loans in order to make these tariffs at a lower level. For this, there was a great need to supplement the domestic natural gas reserves.” He equates the crisis to the under exploration of domestic gas resources. Kamal learned of the potential energy sources while he was working with the global oil and gas team in Washington DC. IFC was then supporting Cairn Energy in the Sangu gas fields. The area was discovered nearly 20 years ago, located 45 kilometers southwest of Chittagong. Kamal infers that gas discoveries are a matter of hit and miss, depending on how massive the discovery, “I am hopeful about continued gas prospects in Bangladesh because based on generally accepted geological hypothesis Africa moved away from the Bay of Bengal and they have similar geological formations. Given Mozambique’s large gas discoveries being converted to LNG projects, Bangladesh could also have similar potential if sufficiently explored. However, conducive gas prices are needed to incentivize the high cost of offshore exploration.”

The coastal East African nation just signed a sales and purchase agreement for over 15 year LNG with the French company, Electricite de France. The projector overseer, Anadarko Petroleum will supply 1.2 million metric tons per year under the contract. The company currently oversees more than a quarter of LNG projects in Mozambique. It recently received approval for onshore facilities to export gas. The project is estimated to be $20 billion and will start with two trains that have a capacity of 12 million tons per year and is expected to extend to eight trains that will produce 50 million tons.

Similarly, Bangladesh’s geographic position makes it a gas-prone area and not an oil-prone one. Kamal deciphers the concept of gas prices when there is a domestic reserve, “The price of gas in Bangladesh is relatively lower in comparison to the international arena. To Bangladesh’s credit, the nation has been implementing a number of gradual gas price increases for the last five to six years. When you introduce LNG, it dispels the need for expensive liquid fuels and supports bringing gas prices gradually closer to an international level.” The initiation to realize produced natural gas could easily take a decade after initiating exploration to entirely materialize. Therefore, if they are not taken now, international investors will cease to consider financial opportunities in Bangladesh.

SCALING SOLUTIONS FOR A RADIANT NATION

SCALING SOLUTIONS FOR A RADIANT NATION

LNG comes as a viable source of energy because it expands 600 times in its gaseous state, 1 unit of LNG is equivalent to 600 units of natural gas. Wendy understands that LNG is also practical in the context of Bangladesh because it is easy to transport, “One of the key benefits is that regasified LNG can be integrated into the gas transmission system. When CNG started, you had to convert so many stations in order to accommodate the vehicles and LPG. LNG can be moved into the natural gas pipeline so it is immediately and readily available for commercial, industrial, and even residential purpose.” This is well-timed for Bangladesh the economy is growing and the country recently graduated from an LDC. Nevertheless, 50% of enterprises cite lack of access to energy as the primary factor for lagged production. In order to propel the nation, further infrastructure changes are a prerequisite. Kamal elaborates that this growth helped entice investors, “Bangladesh steady macroeconomic growth in the past decade is notable. Nevertheless, manufacturing activities are constrained by energy and power supply. If you reduce the cost of energy and you make the supply more reliable, Bangladesh’s productivity and manufacturing would be more competitive. So this is addressing a key constraint for economic development and would only help that trajectory, leading to a positive cycle.”

Bangladesh recently discovered a gas reserve in the southern coastal region of Bhola; it is reported that the reserve contains 600 billion cubic feet of gas; this would be the 27th in the country. Wendy clarifies that these reserves are still important, “Bangladesh will not be able to completely rely on LNG, and it will act as a supplement to the natural reserves. I believe that these gas systems provide a more appropriate price point in the consideration of whether the nation’s offshore gas reserves should be further explored.” She underlines that this is not an either-or situation. Exploration of alternative sources is the key to meeting the unmet supplies that are needed domestically. The use of alternative fuels would combat the detrimental air pollution scenario. Dhaka has been ranked one of the most polluted cities in the world with an air pollution index of 195. “It is also very important to note that even though Bangladesh has a strong use of natural gas in power generation. There are also numerous plants that make use of heavy fuel oil and even diesel when it comes to co-generation for industrial use. If we can continue to increase the gas availability, that mix of power generation for fuels will be cleaner. Industries will also find incentive in this mechanism as it is cheaper than liquid fuels.” LNG completely reduces the emission of sulfur oxides and particulate and approximately 90% of nitric oxide, making it a much greener option.

INNOVATION: THE ULTIMATE FUEL FOR ADVANCING

The Moheshkhali Floating Liquefied Natural Gas (LNG) terminal has already received recognition at the IJ Global Award 2017 for ‘Midstream Oil and Gas Deal of the Year’. Wendy conceives this recognition as IFC work towards sustainable development, “Clean power production is a key part of our goals. We look for the highest efficiency of power generation when it comes to natural gas spaces. This objective includes increasing the availability of fuels in order for power generation to source predominantly through natural gas. And we would like to see the diversification of energy source with renewable energy in the equation.” IFC strives to create a deeper understanding of how Bangladesh can further engage itself in the international market while maximizing returns to all stakeholders, particularly the people of Bangladesh. “The Moheshkhali project will augment the gas supply by 20%, introducing sufficient gas for up to 3,000 megawatts of power. In perspective, that is enough to power over 3 million homes. We are proud that this pioneering project has had a ripple effect in the energy sector. Our agreements have been replicated to accelerate many ongoing projects with the likelihood of other LNG terminals in the country.”

*Diagram and Photographers from Excelerate Energy

Source: Reuters, IGA, The Motley Tool, Bloomberg