United in vision and strategy, UCB Investment Limited has emerged as the number one investment bank in Bangladesh within just five years.

UCB INVESTMENT LIMITED: A STRONG START

UCB Investment Limited (UCBIL) is the wholly owned investment banking subsidiary of United Commercial Bank PLC (UCB), one of Bangladesh’s largest and most respected financial institutions. Since receiving its merchant banking license from the Bangladesh Securities and Exchange Commission (BSEC) on 5 October 2020, UCBIL has pursued an ambitious vision: to become the leading one-stop investment bank in Bangladesh, providing 360-degree financial solutions under a single roof.

Although still young in years, UCBIL has emerged as a dominant force in Bangladesh’s capital markets. By leveraging the brand strength, financial backing, and extensive client network of UCB Group, and combining it with its own innovation and execution capacity, UCBIL has created a platform that meets the evolving needs of corporates, financial institutions, and investors. In less than five years, the firm has executed a record number of transactions and built a reputation as the No. 1 investment bank in Bangladesh.

THE UCB ECOSYSTEM: STRENGTH IN SYNERGY

UCB Investment Limited (UCBIL) draws its strength from the broader UCB Group ecosystem. Its parent, United Commercial Bank PLC (UCB), is one of Bangladesh’s largest first-generation banks and a recognised champion in trade finance. This foundation provides UCBIL with unmatched credibility, resources, and access to a nationwide client network. Alongside the bank, UCBIL benefits from two sister concerns, UCB Stock Brokerage Limited, the leading stock brokerage house in Bangladesh, and UCB Asset Management Limited, the fastest-growing asset management company in the nation. Together, these entities form a powerful ecosystem where clients can access the full spectrum of investment banking services under one roof. This synergy allows UCBIL to deliver integrated, end-to-end solutions that go beyond individual transactions, helping clients achieve their long-term financial objectives.

A PROVEN TRACK RECORD

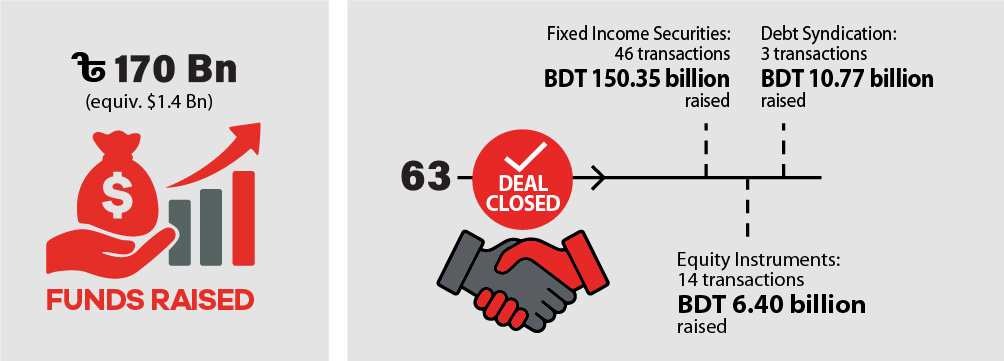

In less than five years, UCB Investment Limited has completed 63 transactions, raising nearly BDT 170 billion, approximately USD 1.4 billion, across equity, debt, and hybrid instruments – more than any other investment bank in Bangladesh over the same period. This has established UCBIL as the go-to house for both equity and debt solutions.

In Numbers

– Earned the trust of 20+ leading banks, financial institutions, and corporate clients

– Acted as issue manager for 50% of all bonds listed on the DSE

– Successfully managed 3 of the 4 Rights Issues approved by BSEC in the last 5 years

COMPREHENSIVE 360° SERVICES

UCB Investment Banking Services is the only investment bank in Bangladesh that offers a complete range of investment banking solutions

COMMITMENT TO SOCIAL RESPONSIBILITY AND FINANCIAL LITERACY

At UCB Investment, growth is balanced with responsibility. Through its “Investing in Society (IIS)” initiative, the firm contributes a portion of its fee income to support causes aligned with SDG 3 (Good Health & Well-being), SDG 4 (Quality Education), and SDG 5 (Gender Equality). Initiatives include supporting children’s education, healthcare for underprivileged senior citizens, and empowering women entrepreneurs.

In parallel, UCBIL drives financial literacy through Decode Investment Banking (DIB) – a flagship campaign designed to simplify capital market concepts and engage students, young professionals, entrepreneurs, and peers in the capital markets industry. DIB reflects UCBIL’s belief that financial literacy is a responsibility, not an option.

SHAPING THE FUTURE

In just five years, UCB Investment Limited has become the benchmark investment bank in Bangladesh, combining UCB Group’s strength with its own expertise to deliver innovative, client-centric solutions. Looking ahead, the firm remains committed to expanding into regional markets, nurturing startups, advancing sustainable finance, and shaping the future of Bangladesh’s capital markets.