The last few years have been exceptionally kind to the Bangladesh’s economy. According to the Bangladesh Bank’s data, the country has been enjoying growth rates above 6% in the last ten years and it is expected that it shall further grow by 7% in the fiscal year of 2017. Unsurprisingly the government has designed its policies to support the industries which are contributing to this growth. At a conference arranged by the Dhaka Chamber of Commerce, 32 high growth industries, also known as Thrust Sectors, have been identified in Bangladesh and are expected to fetch billions of dollars in export revenue.

Thrust sectors/industries are identified as those revenue generating industries which contribute heavily to a country’s industrialization process, helps generate employment and adds to the export income. Due to their contribution to the country’s GDP, these industries are nurtured by the government and enjoy benefits such as tax exemptions, reduced tax rates or accelerated depreciation rates. According to Maris Strategies, a UK based think tank, there are 32 thrust sectors in Bangladesh of which 12 are especially promising. They have been identified in the table below:

Agriculture Industry

Bangladesh’s rural economy, specifically the agriculture sector, has played a major role in poverty reduction. According to the World Bank, the sector aided in the reduction of poverty between 2005 and 2010. Bangladesh has tripled its food production between 1972 and 2014 from 9.8 to 34.4 million tons and has the fastest rates of productivity growth averaging around 2.7% per year. The Green Revolution (spread of ‘seed-fertilize-water’ technology) has greatly aided rice production in Bangladesh but there has been surprisingly little research on it.

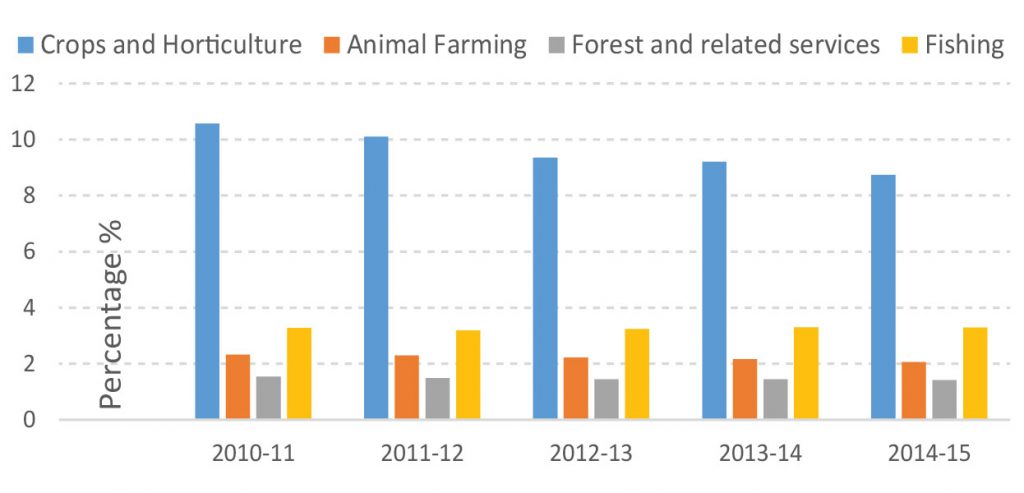

Raw jute and jute products, frozen shrimp and fish, and tea are the major agricultural export commodities. While the volume of agricultural exports (except raw jute and jute manufactures) has remained stable, frozen shrimp, frog legs and fish have emerged as significant export items. Fish export earned $612.5 million in 2016 alone while leather and rawhide racked up $208.5 million, according to World Economic Outlook Database. A complete breakdown of the different sectors, within the agriculture industry, with their contribution to our GDP is given in Figure 1.

Agriculture Sector as % of GDP

Figure 1

Despite its impact on food and nutritional security, income generation and poverty reduction, the contribution of the agriculture sector towards GDP has steadily declined as the economy moves towards industrialization. “Though the direct contribution of the agriculture sector has decreased slightly, its indirect contribution to the overall growth of GDP is significant. The growth of broad service sectors, particularly the growth of wholesale and retail trade, hotel and restaurants, transport and communication were strongly supported by the agriculture sector.” (Ministry of Finance, 2014).

Apparel Industry

Bangladesh has historically been the exporter of jute and jute made products. As the 80’s rolled along, the demand for jute fell. This is when the RMG sector stepped in. Following the implementation of the MFA quota, the industry flourished and was soon a major export item and “now the apparel industry is Bangladesh’s biggest export earner with value of over $25.49bn of exports in 2014-15 financial year.” (bgmea.com.bd, 2016).

Global leaders in the apparel export industry are predictably China and India. However, China is fast losing its place in the international market as its production costs rise. Bangladesh being one of the post –China emerging economies has been competing for the global apparel market share.

Despite these positive developments, Bangladesh needs to address the looming issue of the large import of raw materials for the textile industry “such as cotton, yarn, fabrics, staple fibers and accessories for its readymade garments (RMG) industry, which is nearly 35 %of total imports.” (thedailystar.net, 2016). This is shown in Figure 2.

Import and Export of Raw Materials

Figure 2

In order to move forward Bangladesh requires both medium and long term strategies for the apparel sector. “European and American buyers have identified political stability as the key area of risk in Bangladesh. The country also needs to address the qualitative and quantitative expansion of the industry meaning it should be able to adjust its manufacturing capacity to changing consumer demand. Other areas such as reduction in production and distribution time, expansion of linkages and compliance with the code of conduct with the code of buyers will further their hold in the market.” (thefinancialexpress-bd.com, 2015).

Pharmaceuticals Industry

The Pharmaceuticals sector has been a major thrust sector for Bangladesh. The industry is known for employing high skilled manpower and advanced machinery to help produce universal medicines and vaccines for both local and international markets at competitive prices. According to Bangladesh Brand Forum, the sector was valued at $1.2 billion in 2016 and the figure was expected to grow to $2 billion by 2018. The BRIC nations (Brazil, Russia, India, and China) accounts for almost 70% of all pharmaceutical market sales. Bangladesh has been listed as a Tier 3 country and is expected to contribute 6-7% to the industry by 2017.

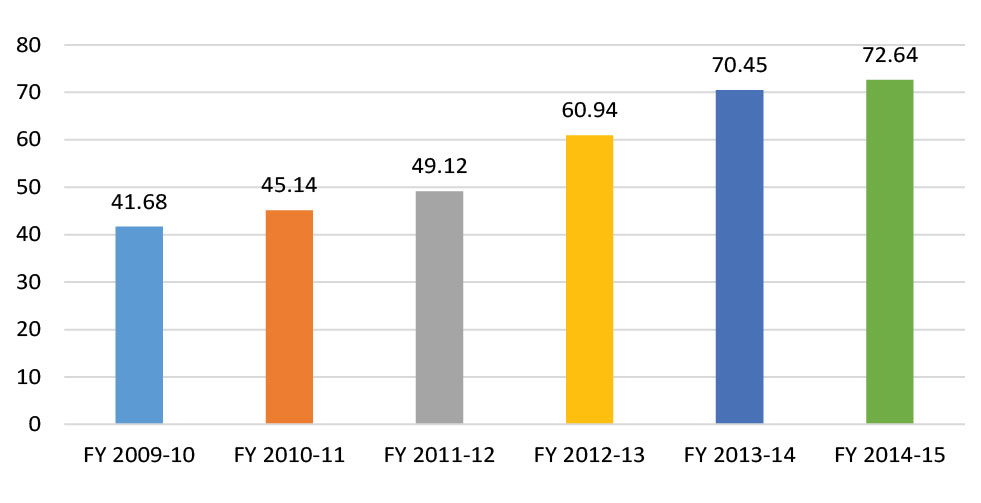

As a member of the WTO, Bangladesh enjoys the benefits of intellectual property rights that allows producing generic drugs and exports until 2032, providing an advantage to the local manufacturers and exporters. This has allowed pharma companies to exports to 107 countries in Europe, Asia, Africa and Latin America with export standing at $72 million in 2015.

Pharmaceuticals Products Export (USD Million)

Figure 3

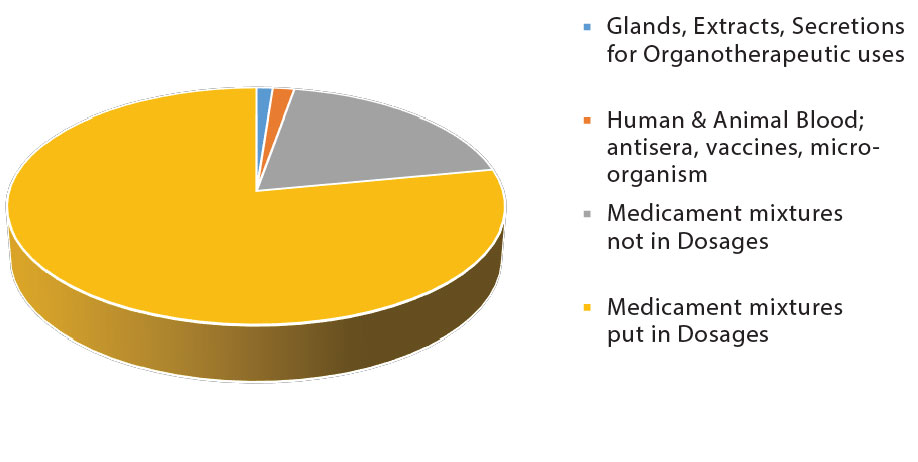

Itemwise Export in FY 2014-15

Figure 4

A healthy growth trajectory has encouraged the pharmaceutical manufacturers towards R&D for newer drugs, and to further hearten the producers the government has extensively imposed lower or zero import duty and VAT for certain raw materials/items and certain capital machineries, and also allowed tax holidays of four to six years to investors in this sector.

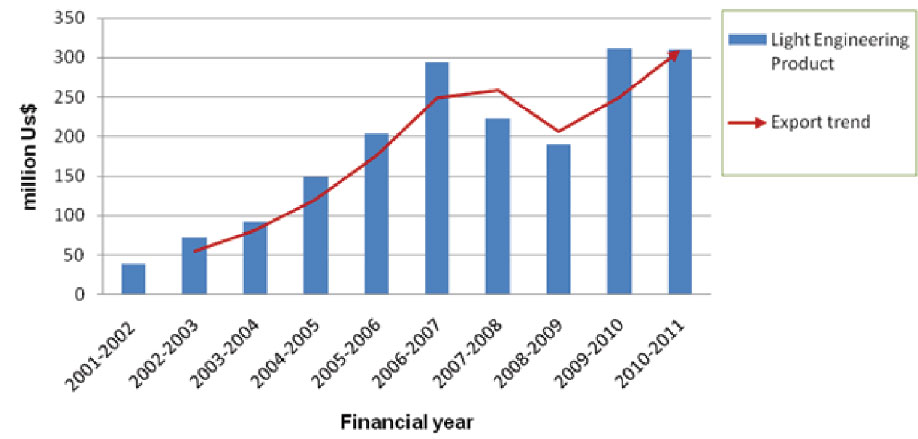

Light Engineering Industry

The Light Engineering (LE) sector has contributed greatly to technological advances, economic development along with wide opportunities in employment generation. This labor-intensive sector produces a diverse range of items, including machinery parts, plant machinery, small tools, toys, consumer items and paper products for the domestic market. The sector has been termed as ‘the mother of all sectors’ because of the support it provides to the other sectors. According to a study conducted by BUET the LES comprises of 40,000 companies and employs about 800,000 workers. Although exports from the sector have been rising, greater investment and additional government support could see other local industries reduce their reliance on certain products (which would otherwise be imported) by purchasing them from local producers in the Light Engineering sector.

Energy Sector’s Share as a % of GDP

Figure 6

Energy Sector

The Bangladesh Bureau of Statistics (BBS) reports that the Energy Sector (electricity, water and gas) added Tk 198,682 million to the country’s GDP in the year 2014-15. This was about 1.37% of the GDP, a marked fall compared to the fiscal years of 2012 and 2013.

Regardless, the solar power sector has been identified as a thrust sector. “The government has planned to take 2000 acres of land in Mirersorai and Gaibandha to establish solar parks.” (bdreports24.com).

Additionally, the government plans to make electricity available to 100% of the population by the year 2021 allowing this sector more room to grow. Nonetheless, there are several challenges hindering this growth, namely the import of low grade modules, the absence of appropriate government policies and the high interest rates being charged by banks which deters further investment.

Energy Sector’s Share as a % of GDP

Figure 6

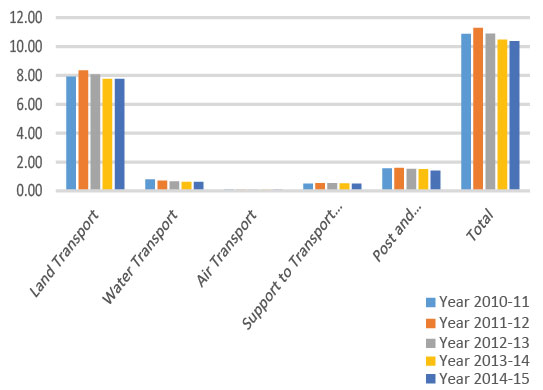

Infrastructure Sector

Being amongst the top 12 developing countries, Bangladesh’s infrastructure is in a desperate need for more investment in order to update its current inadequate facilities. “Access to basic economic infrastructure such as roads, communication, electricity, ICT, energy, power, water and sanitation still remains a strategic challenge on the way to industrialization and poverty alleviation.” (thefinancialexpress-bd.com, 2016). Our social infrastructure such as education and healthcare is also lacking. Thus its surprising that the governments allocation of infrastructure funds as part of the Annual Development Plan has consistently declined. It fell from 35.3% in the fiscal year 2012 to 32.1% in FY 2014. The infrastructure sectors contribution to the GDP in percentages is shown below.

Infrastructure Sector as % of GDP

Figure 7

ICT Sector

‘Vision 2021’ is a target set by the Bangladeshi government to make Bangladesh a middle income country with the help of ICT (information and Communication Technology). Their aims is to craft a favorable business environment for innovative companies. ICT being a thrust sector has prompted the government to take various initiatives to achieve the target. Considerable achievements in the IT sector have already been made over several years towards building a ‘Digital Bangladesh’ and more initiatives are coming. However, Bangladesh should concentrate towards further developing the IT sector to draw the attention of foreign investors while at the same time encouraging our entrepreneurs to launch IT companies here. “According to the Bangladesh Association of Software and Information Services (BASIS), around 800 software and IT-related companies have registered in Bangladesh as of December 2014. The size of the ICT market, excluding telecommunications, is estimated to be worth $300 million.” (export.gov, 2016).

The government has been playing a key role in advancing infrastructure development in ICT, However, it is crucial to remember that both existing and new schemes must be closely linked to the overall economic development and poverty reduction strategy to turn Bangladesh into a middle-income country by 2021.

Ceramics Industry

The global ceramics industry is worth $10 billion and even though Bangladesh is a relatively small player, the ceramics industry has the potential to become a large export revenue earner. Thriving in this sector are tableware, sanitary ware and insulators. Individual growth chart has also been provided according to the BCWMA data The cheap availability of gas and abundant manpower being the key ingredient to the rise of this sector.

The industry employs an estimated 0.5 million workers of which 40% are female according to the Bangladesh Ceramics Ware Manufacturers Association (BCWMA). “The volume of export of tableware ceramics was Tk 3.6 billion while local sales accounted for Tk 3.25 billion. Tiles export was Tk 120 million with local sales of Tk 18.5 billion. For Sanitary ware the shipment was Tk 80 million, while local sale was Tk 3.90 billion in the fiscal year 2014-15, according to BCWMA.” (thefinancialexpress-bd.com, 2015). There are threats to this business too, such as suspension of GSP, high import duty on import materials, high bank interest rate and the latest gas tariff hike.

Frozen Food Industry

This industry has experienced tremendous amount of growth in recent years, raking in $355 million alone in export for the fiscal year 2014-15 according to the BFFEA (Bangladesh Frozen Food Export Association). However, this export is limited to Shrimps and both fresh and saltwater fish. “According to Export Promotion Bureau, the most significant rise in terms of value was seen in shrimps, which posted a 35% growth to over $331m compared to $246m of 2012. While frozen fish saw a 14% decline to $25m, compared to previous year’s $29m.” (dhakatribune.com, 2014).

The Industry faces tough competition internationally and the BFFEA has called for more pointed government policies to promote this sector.

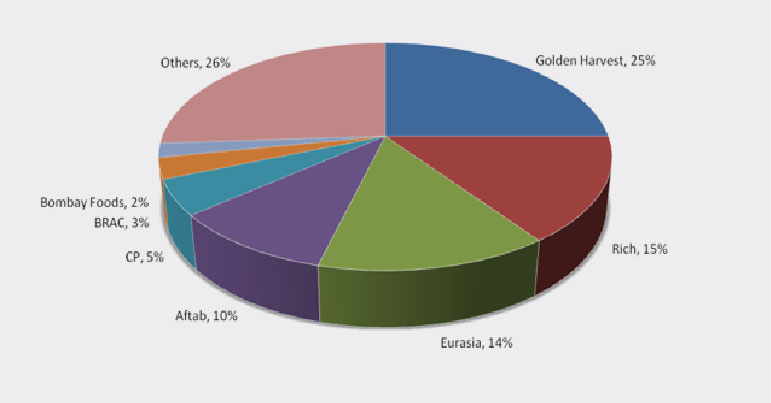

Meanwhile the domestic demand for frozen foods has also seen a healthy growth. The local demand in frozen food mostly includes chicken and has a thriving market of Tk 2672 million. Local brands have sprouted up to support this booming demand, a snapshot of the major market players have been provided in Figure 8.

These industries have greatly attributed to employment, revenue and growth for the country as a whole and are expected to grow even further in the future.

The Frozen Food Market

Figure 8

Tourism Sector

Invigorating tourism trade in a country will yield many benefits for it, starting from and not limited to creating jobs, improving balance of payment, improving the infrastructure and entrepreneur skills and earning foreign exchange and export revenue. The direct contribution of tourism to GDP was Tk 296.6 billion (1.9% of total GDP) in 2014 and is forecasted to grow by 6.1% per annum to Tk 566.3 billion (1.9% of total GDP) by 2025 (thedailystar.net, 2015). On top of that the industry, in 2014, employed 1,984,000 people (a whopping 3.6% of GDP) and the number is expected to rise to 2,492,000 by the year 2025.

Despite all this Bangladesh is lagging behind in the tourism sector compared to other Asian nations such as Cambodia, Laos and Vietnam. The reasons are many fold. Tourism supporting infrastructure is vastly missing. The country lacks quality hotels and resorts, there are very few recreational activities, there is a marked absence of well trained tourist guides and lastly, entertainment facilities such as theme parks, movie theaters, museums are missing. Furthermore, a large chunk of the population cannot speak or read English and are unable to help foreign tourists.

The UN has suggested using the help of the tourism industry to achieve Millennium Development Goals. Thus the Bangladeshi government needs to do a better job of propping up the ailing industry and turn it into the earning sector that it has the ability to become.

Handicrafts Sector

The Handicraft sector is small and and dominated by a few major players namely Aarong, Kumudini, Karuponno Rangpur, Dhaka Trade and Nipun Crafts. The main products are handloom items, leather goods, wooden, jute and bamboo handicrafts, embroidered goods and so on. Many of these items are even exported to foreign countries.

The reason why this sector is relevant is that it is labor intensive and the raw materials required are available in the home country. Moreover, it supports the rural artisans (mostly women) with fair terms of trade. Aarong is a prime example in this sector. It produces a wide range of products ranging from clay pots to diamond jewelry and cotton fabrics. The retail chain alone employs 65000 rural artisans, helping empower them and giving them a chance to alleviate themselves from poverty. With a growing presence abroad, handicrafts companies, like Aarong and Kumudini, have the possibility to become a major thrust sector for Bangladesh.

Healthcare Industry

Bangladesh has made enormous progress in healthcare sector compared to its neighboring south Asian nations by raising life expectancy, reducing mortality of mothers and infant. And it has done all that on a surprisingly low national health budget. The main medical care providers are: government, private sector, NGO’s and donor agencies. However, the sector is characterized by a massive shortage of skilled doctors and nurses and hospitals are disproportionately bunched in the urban areas while shorthanded and poorly equipped in the rural areas.

The government has made an ambitious plan of providing universal health coverage by 2023. In order achieve this, the Ministry of Health and Family Welfare will need to adopt timely and appropriate strategies. Efforts should also be made on strengthening primary healthcare in both urban and rural regions so as to reduce dependency on donors.